How to Spot Remote Job Scams

Remote job scams are just what they sound like: fake work-from-home opportunities cooked up by fraudsters to steal your money or personal information. The dream of a flexible career has, unfortunately, also created a perfect playground for scammers, and these schemes are getting more common and much harder to spot.

Why Are We Seeing So Many Remote Job Scams?

The worldwide shift to remote work has been amazing for so many of us, but it's also created a perfect storm for fraud. Scammers love an environment where they don't have to meet you face-to-face. It allows them to hide behind fake identities and bogus company websites with very little effort, making it tough for even the sharpest applicants to know who they’re really talking to.

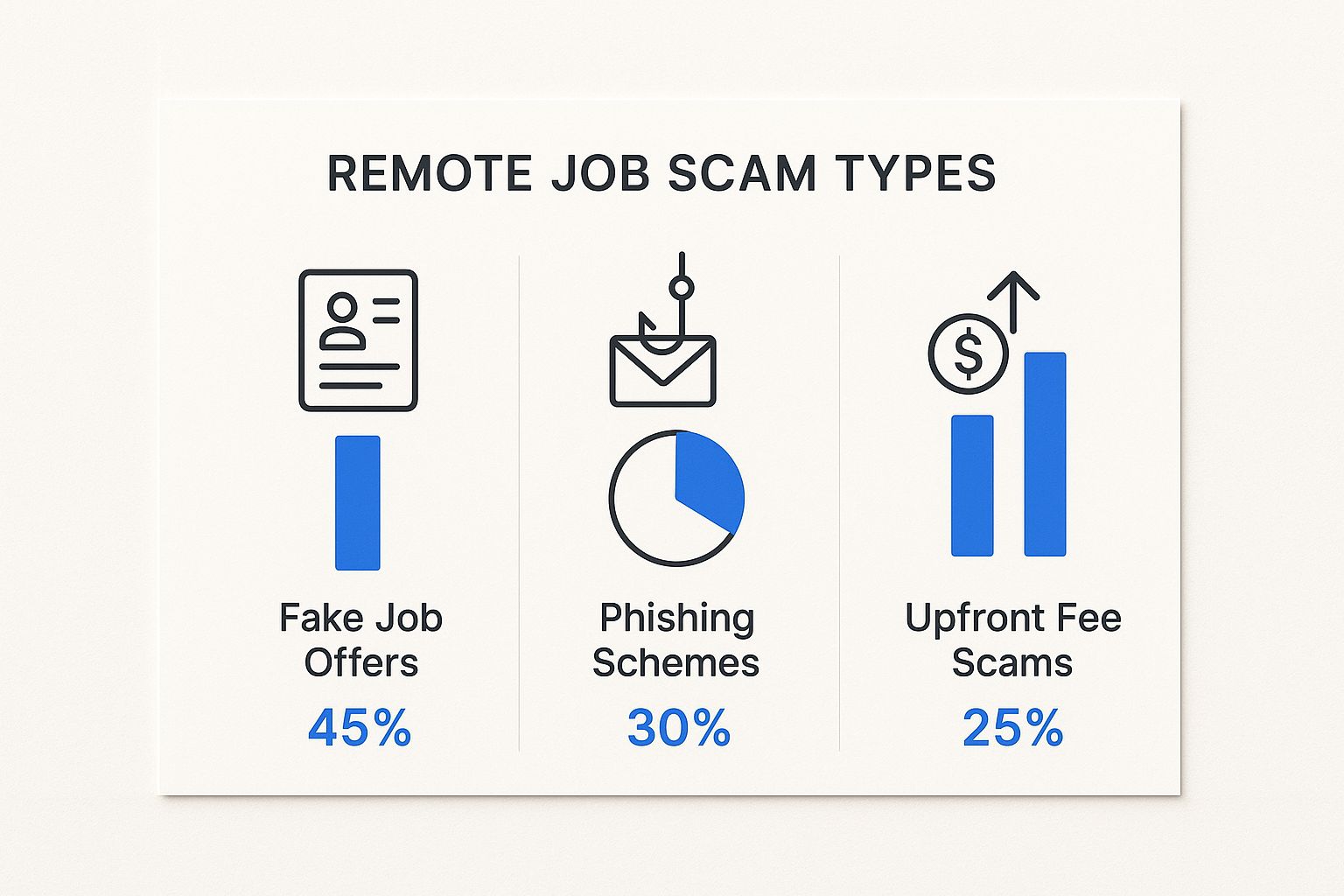

The numbers don't lie. Remote job scams have skyrocketed by about 300% since 2020, riding the wave of the work-from-home boom. The roles scammers dangle are usually ones that seem accessible to almost anyone—think customer service, virtual assistant, and data entry gigs. These jobs typically don't require years of specialized experience, which makes them the perfect bait for a huge pool of potential victims. You can get more details on this alarming trend from The Interview Guys.

The Psychology Behind the Scam

These fraudsters are experts at manipulation. They tap directly into the hopes and very real anxieties of people looking for work, and they know just how to use that to their advantage.

One of their go-to moves is creating a false sense of urgency. You'll see phrases like "hiring immediately" or "only a few spots left" plastered all over their posts. This is a deliberate tactic to rush you into a bad decision before you have time to poke around and notice the red flags. They want you to act, not think.

It’s important to remember that scammers aren't just selling a fake job—they're selling the dream of a better life. They promise incredible pay for what sounds like easy work, financial freedom, and that elusive work-life balance everyone's chasing.

This emotional bait is incredibly effective. When an offer sounds like it could solve all your problems, it’s all too easy to let suspicious details slide.

Who Are the Primary Targets?

Honestly, anyone can get tricked by a really clever scam, but fraudsters definitely have their preferred targets. They tend to focus on people they see as being in a more vulnerable spot or those who are clearly looking for a big change in their lives.

Here's who they often go after:

- Recent Graduates: Being new to the professional world, they might not know what a standard hiring process looks like. Their eagerness to land that first job makes them a prime target.

- Career Changers: If you're trying to switch industries, you might feel a little out of your element and be more willing to go along with an unusual "hiring" process.

- Parents Needing Flexibility: That promise of a high-paying job from home is a powerful lure for parents trying to juggle a career and family life.

- The Unemployed or Underemployed: When you're feeling financial pressure, an offer that seems "too good to be true" can feel like a lifeline you have to grab.

By getting wise to their tactics and understanding why you might be a target, you can put up a much stronger defense. Knowing what scammers are looking for is the first step in making sure your hunt for legitimate remote jobs is a safe one.

How to Spot the Red Flags of a Fake Job Offer

Scammers might be clever, but they’re almost never perfect. They almost always leave a trail of subtle but critical warning signs. Once you learn what to look for, these red flags become your best line of defense against the growing wave of remote job scams.

It’s about moving past generic advice and learning to dissect the actual tactics they use. A fake job offer isn't just one big mistake; it's a collection of small inconsistencies that, when you add them up, paint a very clear picture of a scam.

Vague and Unprofessional Communications

Your first contact with a potential employer says a lot. Legitimate companies invest time in crafting professional, clear, and specific messages. Scammers, on the other hand, usually rush this part, and their carelessness is often your first clue.

Start with the job description itself. Is it packed with buzzwords like "unlimited earning potential" but gives you almost zero detail about what you'd actually do every day? A real job posting will lay out specific duties, necessary skills, and how the role fits into the bigger picture.

Also, really scrutinize the language in their emails and messages. A minor typo can happen to anyone, but scam messages are frequently riddled with glaring grammatical errors, awkward phrasing, or a weirdly unprofessional tone. An email from a "hiring manager" at a big tech company shouldn't read like a text message someone fired off in a hurry.

A Suspicious Interview and Hiring Process

The goal of a real hiring process is to find the best person for the job through structured, meaningful conversations. Scammers want to skip all that and get to your personal information or your money as fast as possible.

One of the biggest giveaways is an interview conducted entirely over text or a chat app like Telegram or Google Chat. While some initial screening might happen this way, a real company will eventually want to speak with you, either on the phone or over a video call. Scammers love hiding behind text to conceal their identity.

Another major warning sign is being hired on the spot after little to no real interview. It might feel flattering, but no credible company hires someone for a skilled position after a brief text exchange. This is a classic tactic meant to create a false sense of urgency and excitement, hoping you'll lower your guard.

To help you quickly tell the difference, here’s a breakdown of what to expect from scammers versus legitimate employers.

Common Red Flags in Remote Job Scams

| Red Flag Indicator | What Scammers Do | What Legitimate Employers Do |

|---|---|---|

| Communication Style | Use generic greetings, have poor grammar, and create a sense of urgency. | Address you personally, maintain professional language, and follow a structured timeline. |

| Interview Method | Insist on text-only interviews via apps like Telegram or Google Chat. | Conduct interviews over the phone or video calls (e.g., Zoom, Google Meet). |

| Hiring Speed | Offer you the job immediately with little to no real vetting. | Follow a multi-stage process with multiple interviews and reference checks. |

| Job Description | Post vague descriptions with high pay for little required experience. | Provide detailed responsibilities, qualifications, and company information. |

| Contact Information | Use personal email addresses (e.g., @gmail.com) and have no online presence. | Use official company email domains and have verifiable professional profiles. |

| Requests for Money | Ask you to pay for training, background checks, or equipment upfront. | Never ask for payment from a candidate; they cover all hiring-related costs. |

Think of this table as a quick gut check. If you find yourself ticking off multiple boxes in the "What Scammers Do" column, it's time to walk away.

The Upfront Payment Scheme

This is the most direct—and damaging—red flag of all. Let’s be perfectly clear: a legitimate employer will never ask you to pay for anything to get a job. This includes asking you to cover costs for:

- Training materials: Any real company provides its own training.

- Background checks: The employer always pays for this.

- Software licenses: This is a business expense, not yours.

A particularly nasty version of this involves buying your own work equipment. The scammer sends you a fraudulent check, tells you to deposit it, and then instructs you to immediately wire a portion of it to their "preferred equipment vendor." By the time your bank discovers the check is fake, the money you wired is long gone, and you’re on the hook for the entire amount.

While it's easy to think scams only target remote jobs, the reality is more complex. A recent study of over 2,670 fraudulent social media posts found a surprisingly even split: 43% targeted remote jobs, 42% were for on-site roles, and 15% were hybrid. However, remote roles are especially vulnerable because the lack of in-person interaction makes it so much harder to verify if the recruiter or the company is real. You can learn more about these findings in this breakdown of how scammers exploit social media for job fraud.

How to Verify Any Remote Job Opportunity

That nagging feeling in your gut is a great starting point, but you need more than a hunch to confirm a remote job scam. The best way to protect yourself is to put on your detective hat and start digging. The goal is simple: independently verify everything the supposed "employer" tells you.

Don't worry, this isn't as complicated as it sounds. By focusing your investigation on a few key areas, you can quickly tell if you're dealing with a real company or a carefully crafted fraud.

Do They Have a Real Digital Footprint?

Every legitimate business leaves tracks online. Scammers, on the other hand, often throw up a flimsy, fake online presence that crumbles the moment you poke at it.

Your first move should be a simple search for the company's name. But don’t just click the first link you see—anyone can build a convincing-looking website. You're looking for a collection of independent sources that all point to the same, real company.

Here’s a checklist of what to look for:

- A Professional Website: Does the URL actually match the company name? Check for "HTTPS" security and give the site a thorough read. Is it riddled with typos, weird grammar, or vague corporate jargon that seems copied and pasted?

- LinkedIn Presence: A real company will have a solid LinkedIn page, complete with a list of current employees. Click on a few of those employee profiles. Do their work histories and connections seem legitimate?

- Third-Party Reviews: Look up the company on sites like Glassdoor or the Better Business Bureau (BBB). No reviews at all can be a red flag, as can a sudden wave of recent negative reviews warning of a scam.

- News and Public Mentions: Has a reputable news outlet, trade publication, or industry blog ever mentioned this company? A real business will have some kind of public record beyond its own website.

If your search comes up empty, or worse, you find forum posts from people reporting scams with that company name, you can stop right there.

Who is Really Contacting You?

Scammers have gotten incredibly good at impersonating real people from real companies. They'll lift a recruiter's name, photo, and title to seem credible. This is why verifying the individual is just as important as verifying the company.

Key Takeaway: Never, ever trust the contact information provided in an unsolicited email or message. Scammers will create look-alike email domains (like "jane.doe@company-careers.com") to trick you. Your job is to find the official contact info yourself.

Head directly to the company’s official website or their verified LinkedIn page. Can you find the person who supposedly reached out? Does their title and role match what they told you? Critically, does the email address or phone number you find on the official site match the one they used to contact you?

If you can’t find them anywhere, or their official contact info is different, you're almost certainly dealing with an imposter.

A Few Technical Tricks to Expose a Fake

Sometimes, a simple tech trick can unravel a scam in seconds. These tools are surprisingly effective at unmasking the fake materials scammers depend on.

One of my favorite methods is the reverse image search. If the recruiter's profile picture looks a little too perfect or generic, save the image and upload it to Google Images. You’ll quickly find out if it’s a common stock photo or a picture stolen from an unsuspecting person's social media. You can do the same thing with a company logo to see if it was ripped off from another business.

This one move can completely dismantle the fake persona. If their "headshot" turns out to be a stock photo titled "friendly business professional," you know it's time to move on.

The Ultimate Sanity Check

If you've run through these steps and still feel a bit unsure, there's one final, foolproof way to get an answer: contact the company directly using information you find yourself.

Do not reply to their email. Don't call the number they gave you. Instead, go to the company’s official website, find their main phone number or HR department email, and reach out.

Simply explain that you were contacted about a role and want to confirm the job opening is legitimate. A real HR department will be happy to help. A scammer, on the other hand, is betting you'll never take this one extra step. It’s a simple action that cuts right through the deception and is essential for a safe job hunt, especially when sifting through the many remote jobs in the USA.

The Hidden Costs of a Remote Job Scam

When you hear "remote job scam," you probably think of losing a few hundred dollars on a bogus equipment purchase. That’s a painful hit, for sure, but it's often just the first punch. The real damage from these scams goes much deeper, creating a ripple effect that can disrupt your life for months, or even years.

It’s not just a one-and-done financial loss. It's a full-blown assault on your personal security and peace of mind. Getting a clear picture of these hidden costs is the best motivation you'll ever have for staying sharp during your job search.

The Immediate Financial Drain

First, let's talk about the most obvious cost: the money stolen directly from you. The classic move here is the fraudulent check scheme. A scammer sends you what looks like a legitimate check—often for thousands of dollars—to "buy your work-from-home equipment." They tell you to deposit it immediately and then wire a portion of that money to their "approved vendor."

Here’s the catch: the check is a dud. It inevitably bounces a few days later, but the money you wired is already gone for good. Your bank will hold you responsible for the entire amount of that bad check, instantly putting you $2,000 to $5,000 in the hole. That kind of loss can wipe out your savings in a single afternoon.

The financial fallout from job scams has absolutely exploded. Data from the Federal Trade Commission (FTC) shows that reported losses skyrocketed from $90 million in 2020 to a staggering $501 million in 2024. That number alone shows just how sophisticated and widespread this threat has become.

These aren't just small-time hustles; they're large-scale operations built to drain as much money as possible before vanishing. If you want to dive deeper into the data, it’s worth reading about how criminals exploit personal data in job scams to understand their methods.

The Lingering Threat of Identity Theft

Losing money is awful, but what scammers often steal next is far more valuable: your identity. During their fake hiring process, they’re not just trying to get your cash; they’re gathering a treasure trove of your most sensitive personal information.

They’ll ask for all the things a real employer would need, but in their hands, this data becomes a weapon.

- Social Security Number: This is the master key to your financial life. Scammers use it to open new credit cards, apply for loans, or even file fake tax returns in your name.

- Driver's License: A copy of your license gives them your photo, full name, address, and date of birth—everything needed to bypass security checks.

- Bank Account Details: They'll ask for this info, claiming it's for "direct deposit." In reality, it gives them a direct line to drain your accounts.

Once they have this data, the real nightmare begins. You might start getting collection calls for loans you never took out or bills for credit cards you never opened. Untangling the mess of identity theft is a long, exhausting, and incredibly stressful ordeal.

The Unseen Emotional and Psychological Toll

Beyond the financial and logistical chaos, falling for a remote job scam takes a serious emotional toll. It's a violating experience that can leave you feeling embarrassed, angry, and deeply distrustful. It’s also something many victims are hesitant to even admit happened.

The emotional fallout is real and shouldn't be underestimated:

- Embarrassment and Shame: It’s so common to blame yourself, wondering how you could have been so easily tricked. This shame is often what stops people from reporting the crime.

- Anxiety and Stress: The constant worry about your finances and the security of your identity can lead to sleepless nights and a feeling of being completely overwhelmed.

- Loss of Confidence: The scam can shatter your self-confidence, making you second-guess your judgment. This makes it much harder to trust legitimate opportunities, stalling your job search when you need it most.

This emotional damage is a very real, hidden cost. The psychological impact can stick around long after you've sorted out the money, which is why going into your job search with a healthy dose of skepticism is non-negotiable.

What To Do If You've Been Scammed

That sinking feeling when you realize a job offer was a scam is awful. It’s a mix of anger, stress, and embarrassment, but what you do in the next few hours is critical. It's time to act fast to protect yourself.

Don't panic. The key is to move through a clear, methodical plan to lock down your finances, secure your identity, and help authorities catch these criminals.

First, Protect Your Money

Your absolute first priority is your bank account. Scammers move money incredibly fast, so you need to be faster.

Get on the phone with your bank or credit union’s fraud department immediately. Clearly explain what happened and tell them to freeze any compromised accounts. If you sent a wire transfer or, god forbid, paid with gift cards, ask if there’s any way to stop or reverse the payment. It's a long shot, but worth asking.

If you used a credit or debit card, call the issuer and dispute the charge right away. The same goes for payment apps like PayPal or Venmo; use their official reporting channels to flag the transaction as fraudulent. This gets the ball rolling on an investigation.

Next, Secure Your Identity

Once you've dealt with the immediate financial threat, it's time to protect your personal information. If you handed over your Social Security number or a picture of your driver's license, you have to assume you're at high risk for identity theft.

The single most powerful move you can make is to place a fraud alert with one of the three major credit bureaus: Experian, Equifax, or TransUnion. You only have to contact one, and by law, they have to notify the other two.

A fraud alert forces lenders to take extra steps to verify your identity before opening any new line of credit in your name. It's a crucial defense. For maximum protection, you can even go a step further and request a full credit freeze.

Officially Report the Scam

This step isn't just about getting revenge—it's about creating an official paper trail. This record is vital for cleaning up any identity theft issues down the road and gives law enforcement the data they need to connect the dots.

There are two key places you absolutely must file a report:

The Federal Trade Commission (FTC): Go to ReportFraud.ftc.gov and file a detailed report. The FTC is the main agency for tracking these scams, and having an official FTC report is a massive help when disputing fraudulent accounts.

The FBI's Internet Crime Complaint Center (IC3): Submit a complaint at IC3.gov. The IC3 is the FBI’s hub for cybercrime and passes your information along to the right law enforcement agencies.

Why Reporting Matters: It can feel like you're just shouting into the void, but these reports are everything. They help authorities spot patterns, link scams to criminal rings, and ultimately shut them down before they can hurt more people.

Also, don't forget to report the fake job posting on whatever platform you found it on—whether it was LinkedIn, Indeed, or Facebook. Use their reporting tools to flag the post and the user. This simple action helps get the listing taken down so no one else falls for it.

For more insights on staying safe, you can always find helpful resources on the RemoteWeek blog.

Clean Up Your Digital Footprint

Finally, take a breath and do a quick security audit. If you shared any potential passwords or answers to security questions, go change them now on all your important accounts (email, banking, etc.).

This is also the perfect time to pull your credit reports. You can get them for free every week from all three bureaus at AnnualCreditReport.com. Scour them for any accounts or credit inquiries you don't recognize.

Dealing with the aftermath of a scam is draining. Be kind to yourself and just focus on taking it one step at a time. By following this plan, you can take back control and build a solid defense against any further damage.

Got Questions About Job Scams? Let's Clear Things Up.

As you navigate the remote job market, you're bound to run into situations that just feel… off. Trusting your gut is a great first step, but having clear answers to common questions is your best defense against the surprisingly sophisticated scams out there. Let's walk through some of the biggest concerns job seekers have.

When Should I Ever Give Out My Social Security Number?

This is a huge one, and the answer is refreshingly simple: only after you’ve received, reviewed, and formally accepted a written job offer. A real employer absolutely needs your Social Security Number for critical payroll and tax documents, like the I-9 and W-4 forms. This is always, without exception, part of the official onboarding process.

Scammers, on the other hand, try to rush this. They’ll ask for your SSN on the initial application form or during a quick chat-based "interview," usually claiming it's for a "preliminary background check." This is a blaring red flag.

My Advice: Guard your SSN like the key to your financial kingdom. Never hand it over until you have a signed, official offer letter in your hands and you've taken the time to independently verify the company and the person you're speaking with.

If someone is pressuring you for your SSN before an offer is on the table, walk away. It's not a real job. A legitimate company respects the sensitivity of this information and has a secure, formal process for collecting it when the time is right.

Can I Trust Postings on Big Job Boards like LinkedIn and Indeed?

While major platforms like LinkedIn and Indeed have dedicated teams fighting fraud, you can't let your guard down. Think of them as open marketplaces—scammers are incredibly skilled at setting up shop right next to legitimate businesses. They create convincing fake company profiles and craft job listings that look identical to the real thing.

Worse, they often impersonate actual recruiters from well-known companies, lifting their photos and professional details to build a credible front. This is why it’s so dangerous to assume a posting is legitimate just because of where you found it.

You have to treat every single opportunity with the same healthy dose of skepticism, no matter the source.

- Always find the company’s official website on your own (don't use the link in the job post!).

- Cross-reference the recruiter's name and email on the company site or their official LinkedIn profile.

- Check if the job is also listed on the company’s official careers page. If it's not there, that's a problem.

Treat a job board as a starting point for your search, never as a seal of approval.

What if They Send Me a Check to Buy Equipment?

Stop right there. This is one of the oldest and most financially devastating remote job scams, and it still works because it preys on a job seeker's excitement. If a check arrives in the mail with instructions to buy equipment, you are dealing with a scam.

Here’s the breakdown of how this trap is sprung:

- The Fake Check: A scammer sends you a fraudulent check. It's often for a much larger amount than you supposedly need—say, $4,500 for a $2,000 laptop.

- The Urgent Request: They create a sense of urgency, telling you to deposit the check right away and then wire the "extra" funds back to them or to their "approved vendor" for software or supplies.

- The Aftermath: By law, your bank makes the funds available to you quickly, but the check itself takes days or even weeks to be discovered as fake. When it eventually bounces, the money you wired is long gone, and the bank will hold you responsible for the full amount of the bad check. You're left on the hook for thousands of dollars.

A real company will never send you a check and ask for a portion of it back. They will either ship the equipment directly to your home or have you purchase it and get reimbursed through a formal expense report process.

Finding your next remote role shouldn't be this stressful. At RemoteWeek, we focus on providing a platform with vetted job listings, so you can connect with real companies safely. Start your secure job search today at https://www.remoteweek.io.

Article created using Outrank