A Guide to Work From Home Tax Deductions

Before you even think about crunching numbers for expenses, the very first step—and honestly, the most important one—is figuring out if you can even take the home office deduction in the first place. The IRS rules are notoriously strict, and it all boils down to one simple question: What's your employment status?

This single detail is the gatekeeper to the entire deduction. Let's get it sorted out.

Who Actually Qualifies for Home Office Deductions?

I'll cut right to the chase: your shot at claiming home office deductions hinges on whether you're self-employed or a W-2 employee. Under current tax law, these two groups are treated completely differently, and it’s a night-and-day distinction.

Ever since the Tax Cuts and Jobs Act (TCJA) shook things up in 2018, the landscape for W-2 employees changed dramatically. The miscellaneous itemized deduction they used for home office expenses was suspended, and that suspension runs through 2025.

What does that mean for you? If you're a standard employee who receives a W-2, you can't deduct home office costs on your federal tax return. It doesn't matter if your company requires you to work from home. This change impacts millions of remote workers, so it's a tough pill to swallow for many.

To quickly see where you stand, here’s a simple breakdown.

Home Office Deduction Eligibility at a Glance

| Filing Status | Federal Deduction Eligibility | Key Requirement | Alternative for W-2 Employees |

|---|---|---|---|

| Self-Employed (1099) | Yes | Must meet "regular and exclusive use" and "principal place of business" tests. | N/A |

| W-2 Employee | No (until at least 2026) | Federal deduction was suspended by the TCJA. | Some states (like NY, CA, PA) still allow a state-level deduction. |

As you can see, the path is much clearer for some than for others.

The Self-Employed Advantage

If you're a freelancer, independent contractor, or run your own small business, the door to these valuable deductions is wide open. This covers a huge range of professions—graphic designers, consultants, gig workers, you name it. If your income is reported on a 1099-MISC or 1099-NEC form, you're in the right camp.

But just being self-employed isn’t a golden ticket. You still have to jump through two major hoops set up by the IRS.

Key Takeaway: The two absolute pillars of home office deduction eligibility are "regular and exclusive use" and being your "principal place of business." If you fail either of these tests, you can't claim the deduction. It’s that simple.

Understanding the Regular and Exclusive Use Test

This is the rule that trips up so many people. Let's break it down with some real-world examples.

- Exclusive Use: This is non-negotiable. You must have a specific area of your home that you use only for your business. It can’t pull double duty as a personal space. That desk in the corner of the family room where the kids do homework and you watch TV? That won't fly. A guest room that’s also your office only works if you have a clearly defined area within it used solely for work.

- Regular Use: The space has to be used for business on an ongoing, continuous basis. Using it once in a blue moon to sort through receipts won't cut it.

Think of it this way: a spare bedroom that you've fully converted into a studio for your photography business is a textbook example of meeting this test. On the flip side, working from your kitchen table during the day and then eating dinner there at night is a clear violation of the "exclusive use" rule.

Defining Your Principal Place of Business

The second major hurdle is that your home office must be your principal place of business. Now, this doesn't mean you can't ever leave your house to do your job.

It simply means your home is the main spot where you handle the important administrative or management tasks for your business. For example, say you’re a plumber who spends all day at clients' homes. If you come home to a dedicated office space to handle all your billing, scheduling, and supply ordering, that space almost certainly qualifies.

For anyone looking into the world of self-employment and its perks, understanding these tax rules is a big deal. If you're just getting started, you might want to check out our guide on finding the best freelance remote jobs to see what's out there.

A Quick Note on State Tax Laws

While the federal rules are pretty black and white, things can get a little more interesting at the state level. A handful of states—including New York, California, and Pennsylvania—still allow W-2 employees to deduct unreimbursed business expenses on their state tax returns.

It’s always a good idea to double-check your specific state's tax laws. You might find a tax break waiting for you there, even if you’re out of luck on your federal return.

Building Your List of Deductible Expenses

Once you've confirmed you're eligible for the home office deduction, it's time to start cataloging every single potential write-off. I can't tell you how many freelancers and contractors I've seen leave serious money on the table because they overlooked expenses that seemed too small or personal to count.

The trick is to think about your costs in two separate buckets: expenses that are only for your office space and expenses that are shared with the rest of your home.

Direct vs. Indirect Expenses Explained

Getting the hang of direct versus indirect expenses is the bedrock of calculating your deduction accurately. Nailing this distinction from the start helps you avoid costly errors and ensures you claim every penny you’re entitled to.

A direct expense is pretty straightforward—it’s a cost that applies exclusively to your home office. Since these are 100% business-related, you can deduct the entire amount. No complicated math needed.

For example, if you decide to paint your office a more inspiring color, the paint and supplies are a direct expense. The same goes for installing new shelving or dedicated lighting in that room. In fact, getting your workspace environment right is a big deal, and you can learn more about the best lighting for a home office in our detailed guide.

On the other hand, an indirect expense is a cost that benefits your entire home, your office included. For these, you can only deduct the business-use portion, which you'll figure out based on the percentage of your home's square footage that your office takes up.

Common Indirect Expenses You Can Deduct

This is where the real savings start to pile up. These are the household bills you're already paying every month, but now a piece of them can directly lower your taxable income.

Here’s a look at the most common indirect expenses you can deduct a portion of:

- Rent or Mortgage Interest: A percentage of what you pay each month in rent or the annual interest on your mortgage is deductible.

- Homeowners or Renters Insurance: You can write off a portion of your insurance premiums.

- Property Taxes: If you're a homeowner, the business-use percentage of your property taxes is a key deduction.

- Utilities: This is a big one. It covers your electricity, gas for heating, central air conditioning, and water bills.

- General Home Repairs: Did you have to replace the roof or get a new HVAC system? Since that repair benefits the whole house, a portion of the cost is deductible.

Let's say your home office occupies 15% of your home's total square footage. That means you get to deduct 15% of all those indirect costs. Over the course of a year, that can easily add up to thousands of dollars in deductions.

Uncovering Often-Missed Deductions

Beyond the usual suspects like utilities and rent, a lot of self-employed pros miss out on other valuable write-offs. These are the expenses tied directly to the logistics of running your business from home.

Pro Tip: Don't just hunt for the big-ticket items. Those small, recurring costs can snowball into a massive deduction by year-end. The real key to maximizing your savings is diligent, consistent tracking.

Keep an eye out for these frequently overlooked deductions:

- Internet Service: A portion of your monthly internet bill, based on your business use, is deductible.

- Software Subscriptions: Those monthly or annual fees for tools like Adobe Creative Cloud, project management apps, or accounting software are typically 100% deductible.

- Phone Bills: You can deduct the business-use percentage of your personal cell phone or the entire cost of a dedicated business line.

- Home Security Systems: If you keep valuable business equipment or inventory at home, a portion of your home security monitoring fees may be deductible.

The Importance of Year-Round Tracking

The biggest mistake you can make is waiting until April to scramble for receipts and bank statements. Trust me, proactive, year-round tracking isn't just a "nice-to-have" habit—it's absolutely essential for a stress-free tax season and getting the biggest deduction possible.

Set up a simple system that works for you. A dedicated spreadsheet is a fantastic place to start. Just create columns for the date, vendor, expense category (like "Utilities" or "Software"), and the amount.

If you prefer a more hands-off approach, look into accounting apps like QuickBooks Self-Employed or FreshBooks. These tools can sync with your bank accounts, help categorize your spending automatically, and let you snap photos of receipts. This way, you'll have all the proof you need to back up your work from home tax deductions when the time comes.

Choosing the Right Deduction Calculation Method

When it's time to calculate your work-from-home tax deduction, the IRS gives you two ways to do it. Think of it as choosing between a straightforward, paved road and a more scenic trail that might lead to a bigger reward. One is built for speed and simplicity; the other takes more effort but can often put more money back in your pocket.

Your choice is between the Simplified Method and the Regular Method. Neither one is inherently better than the other. The right call really comes down to your specific financial situation, the size of your dedicated workspace, and frankly, how much time you're willing to spend on record-keeping.

Let's dig into how each one works so you can decide which path makes the most sense for you.

The Simplified Method: Quick and Painless

Just like its name suggests, the Simplified Method is designed to be as easy as possible. It’s a great fit for self-employed folks who want to claim the deduction without the headache of tracking every single utility bill or home repair receipt.

Here, you calculate your deduction using a standard IRS rate: $5 per square foot of your home office space. There's a cap, though—it only applies up to a maximum of 300 square feet. This means the most you can possibly deduct using this method is a flat $1,500 for the year.

My Takeaway: The Simplified Method is a fantastic option if you have a smaller office, live in an area with lower housing costs, or just value your time more than squeezing every last dollar out of your return. It seriously cuts down on the paperwork.

You don't have to worry about calculating the business-use percentage of your home or tallying up indirect expenses like mortgage interest and insurance. You just measure your office, multiply by five, and you're done.

The Regular Method: Where You Can Maximize Your Deduction

While the Simplified Method offers convenience, the Regular Method is where the real potential for tax savings is. This approach involves calculating the actual expenses of maintaining your home and office. It absolutely requires diligent record-keeping, but for many people, that extra effort pays off in a much larger deduction.

With this method, you can deduct a portion of your major housing costs—things like mortgage interest, homeowners insurance, rent, utilities, and property taxes. The key is that your home office must be used exclusively and regularly for business, and it needs to be your principal place of business. A spare room that's 100% office? That qualifies. Trying to claim a corner of your living room where the kids also play? That won't fly. You can find more details on these WFH tax rules on Tech.co to see how they apply.

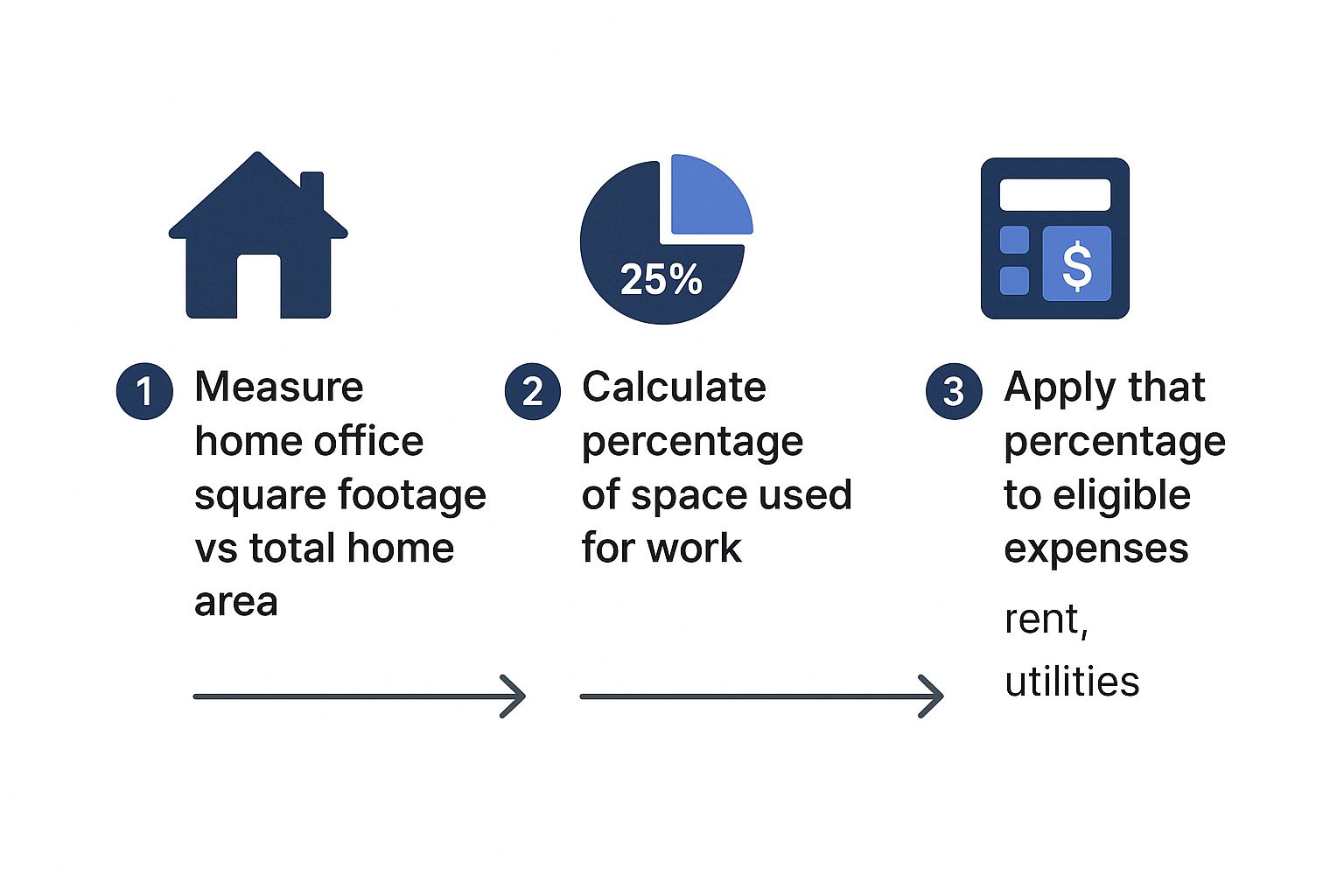

The infographic below really nails down the core concept of the Regular Method: calculating your business-use percentage. This number is the foundation of your entire deduction.

As you can see, getting that percentage right is the critical first step. You'll apply that exact percentage to all your eligible indirect home expenses to figure out your deduction.

Putting Both Methods to the Test: A Real-World Scenario

Let's walk through an example to see how these two methods stack up. Meet Alex, a freelance graphic designer.

- Alex's Home: Alex rents a 1,200-square-foot apartment.

- Alex's Office: A spare bedroom that is 180 square feet is used exclusively as a design studio.

- Business-Use Percentage: 180 sq. ft. / 1,200 sq. ft. = 15%

- Annual Home Expenses:

- Rent: $24,000

- Utilities (electric, gas, water): $3,000

- Renter's Insurance: $300

- Internet: $900

- Total Indirect Expenses: $28,200

Now, let's run the numbers for both methods.

Calculation Using the Simplified Method

This one is fast. Alex's office is 180 square feet.

- Calculation: 180 sq. ft. x $5/sq. ft. = $900

- Total Deduction: $900

With the Simplified Method, Alex gets a clean $900 deduction with almost no paperwork. Easy.

Calculation Using the Regular Method

Here's where Alex applies that 15% business-use percentage to the actual home expenses.

- Deductible Rent: $24,000 x 15% = $3,600

- Deductible Utilities: $3,000 x 15% = $450

- Deductible Insurance: $300 x 15% = $45

- Deductible Internet: $900 x 15% = $135

- Total Deduction: $3,600 + $450 + $45 + $135 = $4,230

The difference is night and day. By putting in the effort to track expenses, Alex can claim a deduction that is $3,330 higher than what the Simplified Method offers. If you live in an area with high rent or a hefty mortgage, the Regular Method is almost always going to be the smarter financial move. It takes more organization, but the payoff can be substantial.

Deducting Your Business Gear And Other Expenses

Writing off your home office goes well beyond a slice of rent or mortgage. If you stop there, you’re likely overlooking valuable deductions: think every gadget, subscription and online course you’ve paid for this year.

The trick is not just spotting deductible items, but mastering the rules for each. The IRS treats a $50 ink cartridge differently than a $2,000 desktop, so knowing when to expense versus depreciate makes all the difference.

Equipment And Asset Deductions

Daily essentials—your laptop, desk, ergonomic chair, even that label maker—qualify as business costs. How you claim them hinges on price and lifespan, leading to two main methods:

| Item Cost | Treatment | Common Examples |

|---|---|---|

| Under $2,500 | Expense | Keyboards, webcams, office supplies |

| Over $2,500 | Depreciate | High-end computers, machinery, desks |

Key Insight: Section 179 lets you deduct a major purchase in one year rather than stretching it out. Under current rules, you can write off up to $1,050,000 of qualifying equipment—computers, furniture and more—provided it’s primarily for business.

This approach can seriously boost cash flow. For a deeper dive into these work-from-home rules, check out Tech.co’s 2025 WFH Deductions Guide.

Uncovering Commonly Missed Deductions

Real life teaches that some of the easiest write-offs slip through the cracks. Beyond your workspace gear, here are the most overlooked home-based business costs—each one has real dollar value at tax time:

- Business Software and Subscriptions: Fully deductible when used exclusively for work. From QuickBooks to Asana and Adobe Creative Cloud, every annual plan counts.

- Professional Development: Online courses, webinars or virtual conferences you paid for to sharpen your skills.

- Industry Dues and Publications: Membership fees, trade magazines and premium newsletters that keep you informed.

- Business Travel: Driving to a client meeting, networking event or supply run? Track your mileage meticulously—every mile translates into savings.

Need ideas for optimizing your home office? Explore our tips on creating effective remote work setups.

Differentiating Business And Personal Use

Many expenses straddle the line between work and life, so you must carve out a reasonable business percentage.

Take your cell phone bill. If you estimate 40% of your calls are client-related, you can claim 40% of the annual service cost. The same logic applies to internet charges—just be ready to explain your methodology if audited.

In practice, keep simple records—monthly summaries or phone logs—and choose percentages you can justify. A little diligence here ensures you maximize deductions without raising red flags.

How to File Without Making Common Mistakes

Knowing what you can deduct is one thing, but getting those numbers onto your tax return correctly is a whole different ballgame. This is where your careful tracking and record-keeping finally pay off. It's also the stage where a simple mistake can cause a major headache or, worse, attract unwanted attention from the IRS.

The two main forms you'll get to know are Form 8829 (Expenses for Business Use of Your Home) and Schedule C (Profit or Loss from Business). The easiest way to think about them is that Form 8829 is your scratchpad for calculating the deduction, while Schedule C is the final report where that number gets listed with your business income and other expenses.

Let's walk through the common traps people fall into so you can file with confidence.

Sidestepping Critical Calculation Errors

The most common slip-up I see is getting the business-use percentage wrong. If your measurement of your office or the total square footage of your home is off, your entire deduction will be skewed. Don't eyeball it—get out a tape measure and double-check your numbers. Precision is your friend here.

Another frequent misstep is trying to claim expenses that don't actually qualify. That "exclusive use" rule is a hard line. Thinking you can deduct part of a new sofa for the living room or a kitchen renovation is a huge red flag for the IRS because those are fundamentally personal spaces. Stick only to the expenses that directly support your dedicated office.

The Income Limitation Rule: A Non-Negotiable

This is a big one, and it catches a lot of freelancers off guard. Your home office deduction cannot be more than the gross income your business generates. Put simply, you can't use this deduction to report a business loss.

Imagine your freelance work brought in $3,000 this year, but your total home office deduction comes out to $4,000. You can only deduct $3,000. The good news? If you're using the Regular Method, that leftover $1,000 isn't lost forever—you can carry it forward to apply to next year's taxes.

Key Takeaway: The IRS views a home office as a place for a profitable business. If your business isn't making money, the deduction can't be used to reduce your other, non-business income. Always look at your net income on Schedule C before claiming the full deduction.

This rule is more relevant than ever. The average salary for a remote worker in the U.S. is now around $57,500 a year, and with nearly 20% of remote professionals planning to move in 2025, state-level tax policies are constantly shifting. This makes understanding core federal rules like the income limit absolutely essential. You can dig into more remote work statistics to see how these trends influence tax regulations.

Your Best Defense Is Good Recordkeeping

Of all the mistakes, this one is the most preventable. If the IRS decides to audit you, they will ask for proof. Without the right documentation—receipts, bills, and a clear breakdown of your office's square footage—they can disallow your entire deduction.

You need a solid paper trail. Whether it's a physical folder or a set of digital files, make sure you have everything organized.

- Proof of Space: Keep a simple floor plan of your home with your office space clearly marked and measured. Photos of the workspace are also great for proving exclusive use.

- Indirect Expenses: File away all your utility bills, rent or mortgage interest statements, and homeowners' insurance premiums.

- Direct Expenses: Hold on to every receipt for things like office furniture, a new desk chair, or specific repairs made only to your office.

By steering clear of these common pitfalls, you’re not just getting the biggest deduction you're entitled to—you're making sure your tax return is accurate, defensible, and audit-proof.

Answering Your Top WFH Tax Questions

Even with a good grasp of the rules, real-life tax situations can feel a bit murky. Let's walk through some of the most common questions that pop up for self-employed folks figuring out their work-from-home deductions. Getting these details right can make a huge difference come tax time.

Can I Claim the Home Office Deduction if I Rent?

Absolutely. This is a common misconception, but renters are just as eligible as homeowners for the home office deduction. The main difference is simply which expenses you get to write off.

Instead of things like mortgage interest, you'll deduct a percentage of your monthly rent payment and your renter’s insurance. The math is the same. For example, if your office space is 15% of your apartment's total square footage and you pay $20,000 a year in rent, you could deduct $3,000. On top of that, you could also write off 15% of your utilities.

What Kind of Records Should I Keep for an Audit?

Think of good documentation as your best insurance policy against an IRS headache. What you need to hang onto really depends on which deduction method you go with.

- For the Regular Method: You need to keep everything. I'm talking receipts, utility bills, bank statements showing payments, and even canceled checks for all the expenses you're claiming.

- Proof of Space: It's also incredibly wise to have a basic floor plan with your home office dimensions marked out, along with a few photos of the space. This is your proof that the area is used exclusively for work.

Now, if you go with the Simplified Method, you can breathe a little easier—you don't need to keep records of actual expenses like rent or electricity bills. But you do still need to be able to prove the square footage of your office and show that it's a dedicated workspace.

Key Takeaway: Your home office deduction is only as strong as your records. An organized system for tracking expenses and square footage is non-negotiable, especially if you use the Regular Method.

Does Working from My Kitchen Table Count?

I wish I had better news, but this is a hard no. The IRS is notoriously strict about the "exclusive use" test. Any area that pulls double duty for personal life, like your dining table or the living room couch, won't qualify.

Your office needs to be a distinct, separate space used only for your business. This doesn't have to be a whole room with a door—it could be a converted closet or even a clearly partitioned corner of a larger room, as long as it’s never used for anything else. If the kids do their homework there or you watch movies in that spot, it fails the test.

What Happens if My Business Has a Loss?

This is a really important limitation to be aware of. Your home office deduction can't push your business into the red or make an existing loss even bigger. Put simply, the deduction can’t exceed your business’s net income for the year.

So, if your business is already operating at a loss before you even factor in the home office write-off, you can't take the deduction for that tax year. But there's a bit of a silver lining if you use the Regular Method: you can carry forward the unused portion of the deduction to the following year, assuming your business is profitable then. The Simplified Method, however, doesn't offer this carryover option.

Ready to find a remote job that makes navigating these deductions worthwhile? RemoteWeek is your go-to source for the best remote opportunities from top companies. Start your search today at https://www.remoteweek.io.