Independent Contractor vs Employee: A Clear Guide for Tech Pros

The real difference between an independent contractor and an employee boils down to two things: control and responsibility. An employee is on the payroll, with the company directing their work and handling their taxes. An independent contractor, on the other hand, runs their own show, enjoying more freedom but shouldering the full burden of their own taxes and benefits.

Getting this distinction right is crucial, whether you're a business owner or a professional navigating the modern workforce.

Defining the Core Difference: Independent Contractor vs. Employee

Deciding whether to hire a contractor or bring on a full-time employee is a bigger deal than just picking a job title. This single classification dictates everything from legal obligations and tax implications to the fundamental nature of your working relationship. For businesses, getting it wrong can lead to a world of hurt, including hefty legal and financial penalties.

At the heart of it all is the legal concept known as the "right to control." Both the IRS and the Department of Labor lean heavily on this idea to figure out a worker's true status. They're essentially asking: who is really in the driver's seat?

To get to the bottom of it, they look at the relationship from three different angles:

Behavioral Control: This is all about the how. Does the company tell the worker how to do their job, provide specific training for the role, or dictate the exact methods and processes they must use? The more a company dictates the "how," the more it looks like an employer-employee relationship.

Financial Control: This one's about the money. Who controls the business side of things? We're talking about whether the worker has significant unreimbursed expenses, invests their own money in equipment, and gets paid by the project (via invoice) rather than a set salary.

Relationship of the Parties: This considers the mutual understanding between the worker and the company. Is there a written contract defining the relationship? Does the company provide benefits like health insurance or paid time off? Is the work a core part of the company's main business, and is the relationship expected to be long-term?

These three pillars form the legal bedrock for the day-to-day realities of each role.

At-a-Glance Comparison: Employee vs. Contractor

To make it even clearer, let's break down the fundamental differences in a quick side-by-side comparison. This is the stuff that really matters in practice.

| Aspect | Employee | Independent Contractor |

|---|---|---|

| Payment | Receives a regular wage or salary (W-2) | Submits invoices for payment (1099) |

| Taxes | Employer withholds income and payroll taxes | Responsible for self-employment taxes |

| Control | Employer directs how and when work is done | Has significant autonomy over their work |

| Benefits | Often receives benefits like health insurance, PTO | Must provide and fund their own benefits |

| Tools | Employer provides necessary equipment | Typically uses their own tools and equipment |

As you can see, the lines are pretty distinct. An employee is integrated into the company's structure, while a contractor operates as a separate business entity providing a service. Understanding these core differences is the first step in making the right choice for your needs.

Understanding Worker Classification Tests

Deciding whether to hire someone as an employee or an independent contractor isn't just a choice—it's a critical legal distinction. Government agencies, especially the IRS, have established tests to make sure workers are classified correctly, and getting it wrong can lead to serious penalties.

The whole concept really boils down to one central idea: the "right to control."

At its heart, the question is simple: Who gets to say how the work gets done? The more a company dictates the details, the stronger the case for an employee relationship. This isn't a single checkbox but a holistic look at how the two parties actually work together.

To cut through the confusion of the independent contractor vs. employee debate, the IRS sorts its criteria into three main categories. Think of them as the pillars that support a proper classification.

Behavioral Control

This is all about the "how." It's not just about what gets delivered, but who controls the process and methods used to get there.

You're looking at things like:

- Does the company give detailed instructions on how, when, and where to work?

- Is the worker required to use specific tools or software provided by the company?

- Does the company provide in-depth training on how to perform the job?

For example, a staff software developer who has to attend daily stand-ups, work within a rigid sprint schedule, and use a company-issued computer is clearly under behavioral control. On the flip side, a freelance cybersecurity expert brought in to conduct a one-time audit, using their own tools and methodology, is operating independently.

Financial Control

This category looks at the business side of the job. It helps clarify whether the worker is truly in business for themselves, with the potential to make a profit or take a loss.

Key financial questions include:

- Does the worker have a significant investment in their own equipment and tools?

- Who pays for business expenses? If the company reimburses everything, that points to employment.

- How is the person paid? A regular, predictable salary is a hallmark of employment, while a flat fee per project suggests a contractor.

A freelance graphic designer who buys their own MacBook Pro and Adobe Creative Cloud subscription and invoices clients per project is demonstrating financial control. An employee who gets a bi-weekly paycheck and a company-provided laptop is not.

Relationship of the Parties

The final piece of the puzzle is the nature of the relationship itself, both on paper and in practice. This looks at how both sides perceive and define their arrangement.

The permanency of the relationship is a huge signal. If the work is ongoing and central to the business's core operations, it looks a lot like employment. A project with a defined scope and end date? That's more aligned with a contractor.

Here, you'll look at written contracts that explicitly define the relationship as either employment or contracting. You'll also consider whether the company provides benefits like health insurance, paid vacation, or a 401(k) plan—perks almost exclusively reserved for employees. If the work being done is a fundamental part of what the company does every day, it's very hard to argue that the person isn't an employee.

Analyzing the Financial Realities of Each Role

When you're weighing the choice between being an independent contractor or an employee, the money conversation goes way beyond the number on your paycheck. It’s about the whole financial picture.

For a W-2 employee, there’s a certain comfort in predictability. Your employer takes care of withholding taxes from each check and kicks in their share for Social Security and Medicare. This makes budgeting a lot more straightforward because you know what to expect month to month.

A 1099 contractor, on the other hand, is essentially running a one-person business. You get paid the full, gross amount for your work, but that money isn't all yours. The responsibility for figuring out and paying taxes—including the hefty self-employment tax that covers both employee and employer portions of Social Security and Medicare—falls squarely on your shoulders. This usually means making estimated tax payments to the IRS every quarter to stay out of trouble.

The Hidden Costs of Independence

The real financial divergence happens when you look at benefits. Employees often get access to company-subsidized health insurance, retirement plans like a 401(k) (often with a valuable company match), and paid time off for vacations and sick days. These perks are a huge part of an employee's total compensation, even if they don't show up as a dollar amount on a payslip.

As a contractor, you're on your own for all of it. You have to source and pay for your own health insurance, set up a retirement account like a SEP IRA or Solo 401(k), and budget for any time you take off. If you don't work, you don't get paid. To really understand what you're getting into, checking out a comprehensive insurance guide for independent contractors is a critical first step.

It's easy to get starry-eyed over a high contractor rate, but that number can be deceptive. Once you start subtracting the full self-employment tax, health insurance premiums, retirement contributions, and the cost of unpaid leave, that "higher" income can quickly dip below what a comparable salaried employee takes home.

Of course, the flip side is that contractors can write off business expenses. Getting savvy about all the available https://www.remoteweek.io/blog/work-from-home-tax-deductions is absolutely essential to protecting your bottom line.

Quantifying the Financial Disparity

This isn't just a hypothetical gap; the numbers tell a stark story. When workers are misclassified, they lose out on fundamental protections like minimum wage and overtime. The impact is staggering.

In a state like South Dakota, for example, misclassified workers face annual wage losses of $14,843 and benefit losses of $10,166. That's a total compensation gap of 37.1%.

On a national level, the IRS has found that contractors spend about 13 more hours on their taxes each year and an extra 30 minutes a week on paperwork. It adds up to about 39 extra hours annually—a full work week dedicated to administration. This "time tax" is a very real cost that has to be factored into any financial comparison.

Comparing Autonomy, Career Growth, and Stability

Beyond the numbers and tax forms, the daily realities of being an employee versus an independent contractor are worlds apart. This decision fundamentally shapes your professional journey, how you balance work and life, and your overall sense of security. It's really a classic trade-off: do you prefer entrepreneurial freedom or structured advancement?

For many, the allure of contracting can be summed up in one word: autonomy. As a contractor, you are the captain of your own ship. You pick your clients, you set your hours, and you decide which projects truly spark your interest. This level of control can be incredibly liberating for professionals who thrive on flexibility.

On the other hand, an employee works within a pre-existing framework. Even with remote work, your schedule is still largely tethered to team meetings, project deadlines, and company policies. The upside? You don't have to hunt for new clients or get bogged down in administrative tasks. You get to focus purely on your role.

Charting Your Career Trajectory

Career growth plays out very differently on these two paths. For an employee, the trajectory is often linear and clearly marked. You have promotions, mentorship opportunities, and internal training designed to deepen your expertise within that specific company. You're climbing a corporate ladder, building your career with the backing of an established organization.

An independent contractor’s growth is all about entrepreneurship. Every project becomes a chance to learn a new skill, dive into a different industry, or sharpen business acumen like marketing and negotiation. Instead of climbing a ladder, you're building a dynamic portfolio and a powerful personal brand that makes you an expert on the open market.

The data backs up the appeal of this freedom. A recent study found that 84% of full-time independent workers report being happier than they were in traditional jobs. What's more, 82% of contractors see more opportunities available now than last year, a stark contrast to the 63% of employees who feel the same, showing just how dynamic freelance work can be. You can dig deeper into these trends in this detailed 2025 contractor hiring report.

To get a clearer picture of how these differences play out in real life, let's break down the practical pros and cons from the perspective of a remote professional.

Comparing Key Lifestyle and Career Factors

| Factor | Employee Perspective | Independent Contractor Perspective |

|---|---|---|

| Flexibility | Moderate. Set hours and company-wide meetings often dictate the schedule, even when remote. | High. Full control over when, where, and how you work. You set your own schedule. |

| Career Path | Structured. A clear path for promotions and internal growth. Access to mentorship and training. | Self-Directed. Growth comes from building a diverse portfolio, a strong reputation, and new skills. |

| Income Stream | Stable. A predictable, recurring salary every pay period. | Variable. Income fluctuates with project flow, creating "feast or famine" cycles. |

| Benefits | Comprehensive. Access to employer-sponsored health insurance, retirement plans, and paid time off. | Self-Funded. Responsible for purchasing your own health insurance and funding your retirement. |

| Job Security | Perceived as high, but tied to the success and decisions of a single company. | Dependent on your network and market demand. Multiple clients offer a form of diversification. |

| Admin Work | Minimal. HR and finance departments handle payroll, taxes, and benefits administration. | Significant. You are the CEO, CFO, and CMO. You handle invoicing, taxes, and marketing. |

This table shows there’s no universally "better" option—it all comes down to what you prioritize at this stage in your life and career.

Weighing Stability Against Opportunity

Perhaps the most significant trade-off in this whole debate is stability. Employees get a predictable paycheck, access to benefits, and legal safeguards like unemployment insurance. That financial foundation provides a peace of mind that is invaluable, especially for those with families or major financial obligations.

A contractor's income can be highly variable, with peaks during busy project cycles and troughs during quiet periods. This "feast or famine" cycle requires diligent financial planning and a high tolerance for uncertainty.

However, a contractor's security comes from diversification. By working with multiple clients, you aren't reliant on a single employer for your livelihood. If one project wraps up, others can keep you afloat, creating a kind of resilience that a traditional job can't offer. Ultimately, the choice is about where you find more comfort: in a steady salary or in the control you have over your own destiny.

Why Companies Hire Contractors vs. Employees

When you look at the "independent contractor vs. employee" debate from the company's side of the table, you start to see the strategy behind it all. This isn't a random choice; it's a calculated decision driven by very specific business needs, budgets, and what the company is trying to achieve down the road.

A lot of the time, bringing on a contractor is all about speed and specialized skills. Imagine a company needs to get a new mobile app off the ground. Hiring a freelance UI/UX designer for a three-month project is way more practical than creating a permanent, full-time position. You get an expert on day one without the long-term financial weight of a salary, benefits, and payroll taxes. It’s a surgical strike for a specific, temporary need.

The Strategic Value of Employees

On the other hand, hiring an employee is a long-term investment in the company's foundation and future. When it’s time to build out the core engineering team, a business is looking for people who will stick around, grow with the company, and become deeply embedded in its mission and products.

Employees are the guardians of a company's intellectual property and the heart of its culture. A contractor's job is to deliver on a project; an employee's job is to contribute to the company's overall, sustained success. They're the ones who carry the institutional knowledge and drive innovation from the inside. For a closer look at this, our guide on how to hire remote employees breaks down what it takes to build a truly dedicated team.

From a business standpoint, the choice isn't about which is "better" but which model aligns with the immediate need. Contractors offer flexibility and specialized talent on-demand, while employees provide loyalty, cultural continuity, and long-term institutional knowledge.

This two-pronged approach is how smart businesses scale. They can keep a lean, dedicated team of employees running the core operations while bringing in contractors to handle project spikes, tackle niche tasks, or test out new ideas without adding permanent costs.

Making the Right Choice for Your Remote Career

Figuring out whether to be an independent contractor or a full-time employee is a huge fork in the road for any remote professional. There’s no magic answer here; the best path for you comes down to your personality, financial needs, and what you want out of your career in the long run. This is where you need to get honest with yourself.

Start with a gut check on your tolerance for risk and your willingness to handle the "business" side of work. Are you genuinely okay with managing your own quarterly tax payments, shopping for health insurance, and funding your own retirement accounts? Or does the idea of an employer handling all that complexity bring a sense of relief and stability?

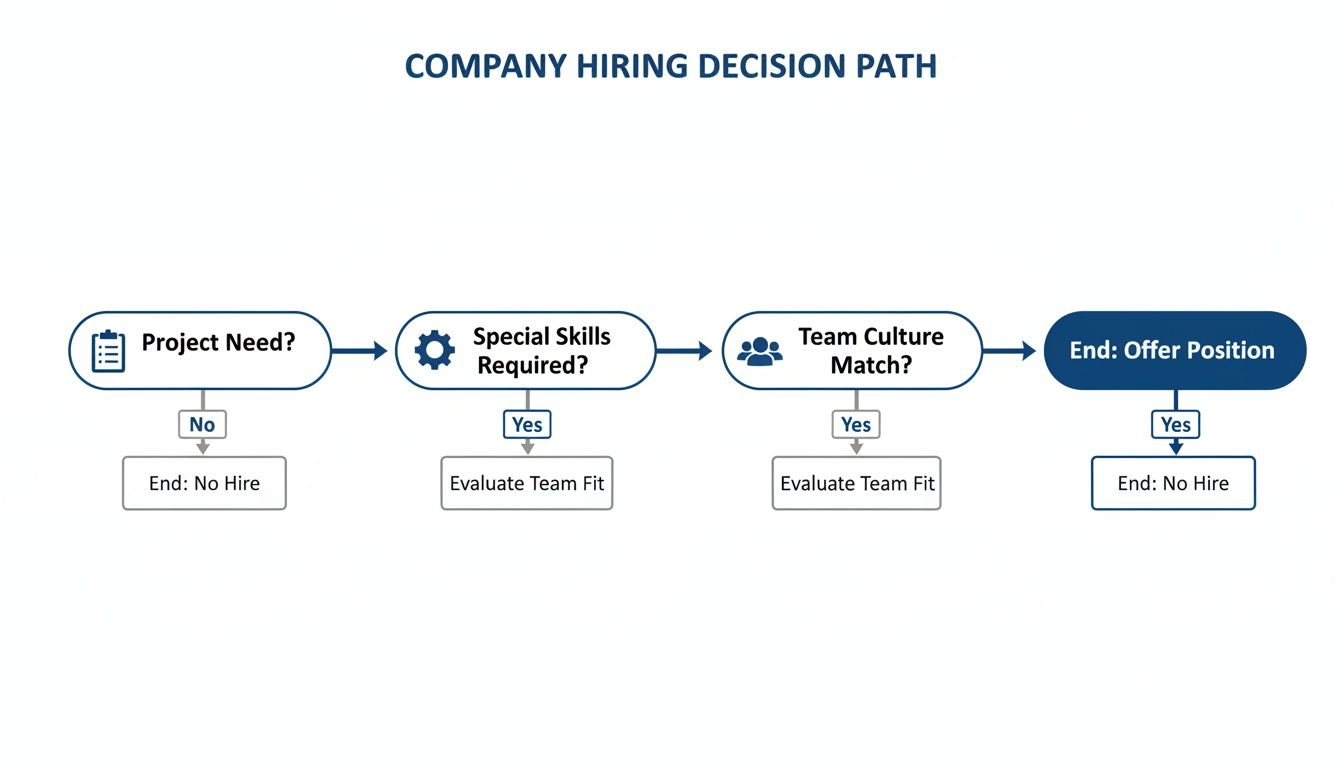

From a company's perspective, the decision-making process often looks something like this.

As the flowchart shows, companies typically bring on contractors for specialized, temporary needs. When they need someone for a long-term role that's central to the team and company culture, they hire an employee. Knowing this can help you position yourself for the kind of opportunities you actually want.

Aligning Your Choice with Your Work Style

Now, think about how you really like to work. Do you do your best work when you have total freedom to set your schedule and run your own projects? Or do you find that you grow more with the structure, mentorship, and clear career path that an employee role often provides?

The real question is this: do you want to build a career within a company, or do you want to build a business of your own? One offers a steady, defined trajectory, while the other provides ultimate flexibility and the chance to be an entrepreneur.

For anyone leaning toward the contractor route, it's vital to think like a business owner from day one. That means understanding the legal structure you'll operate under. For example, you can delve deeper into the nuances of Incorporation vs Sole Proprietorship in Canada to see how these choices can affect your liability and taxes.

To get crystal clear on your decision, ask yourself a few pointed questions:

- Financial Security: What's more important to you—a predictable, steady paycheck, or the potential for higher (but less consistent) income from various projects?

- Benefits: How much do you depend on employer-sponsored health insurance, paid time off, and retirement plans for your overall financial health?

- Career Growth: Do you see yourself climbing a corporate ladder through promotions, or do you get more excited about building a diverse client list and a powerful personal brand?

Answering these honestly will give you the confidence to move forward. If the challenge and freedom of contracting appeal to you, our guide on succeeding in https://www.remoteweek.io/blog/remote-contract-work is packed with practical advice. In the end, the right choice is simply the one that lets you build a remote work life that’s both sustainable and genuinely fulfilling.

Got Questions? We've Got Answers

Digging into the employee vs. contractor debate always brings up a few key questions. Let's tackle some of the most common ones to help you figure out where you stand and what makes the most sense for you.

Can I Really Be an Employee and a Contractor at the Same Time?

Absolutely. It’s actually quite common to juggle both. Many people have a steady W-2 job (full-time or part-time) and pick up freelance projects on the side as an independent contractor.

When tax season rolls around, you’ll get a W-2 from your employer and a 1099 from any client who paid you for contract work. The trick is keeping meticulous records to file your taxes accurately for both income streams. This setup can give you the best of both worlds: the security of a regular paycheck and the freedom and extra income of freelancing.

Just a word of caution: balancing the two takes serious time management. You also have to be mindful of potential conflicts of interest and double-check that your freelance gigs don't break any rules in your employment contract.

What’s the Big Deal With Being Misclassified?

For a worker, being wrongly classified as an independent contractor when you should be an employee is a huge problem. It hits you hard, both financially and in terms of your rights.

Here’s what you stand to lose:

- Key Legal Protections: You’re suddenly outside the safety net of minimum wage laws, overtime pay, family medical leave, and unemployment insurance.

- A Heavier Tax Load: You get stuck paying the entire self-employment tax, which covers both the employee and employer shares of Social Security and Medicare. That’s a hefty 15.3% on the first $168,600 you earn (based on 2024 figures).

- No Company Benefits: Forget about access to company-sponsored health insurance, retirement plans like a 401(k), or any paid time off.

At its core, misclassification is just a way for a company to push its financial and legal burdens onto the worker, usually without giving you the extra pay to cover all those new costs and risks.

Which Is Better for My Career in the Long Run?

There’s no single "better" path here—it’s all about what kind of career you want to build. Each one leads to a very different professional life.

Being an employee puts you on a more structured track. You'll develop deep knowledge within one company, get direct mentorship, and follow a clear path up the corporate ladder. This is a great fit if you thrive on stability and want to become an expert inside a specific organization.

Working as an independent contractor is like running your own business. Your career growth is tied to building a strong portfolio of work, creating a powerful personal brand, and getting good at things like marketing and client management. This route is made for people who crave autonomy, love variety, and want to be the architect of their own career.

Trying to find a remote job that fits your career goals and personal values can feel like searching for a needle in a haystack. RemoteWeek simplifies the search by hand-picking roles from top-rated, employee-first companies. Start your search with confidence and find your next great remote job.