A Modern Guide to Remote Contract Work

Remote contract work is a whole different ballgame compared to your typical 9-to-5. In this model, you’re an independent pro, offering your specific skills to different clients, usually one project at a time. The best way to think about it is running a business of one. You get the freedom to pick your projects and decide where you work, but you're also on the hook for your own taxes and benefits.

It’s a major shift from traditional employment, and it's worth understanding the nuances before you dive in.

What Remote Contract Work Really Means

At its heart, remote contract work flips the classic employer-employee dynamic on its head. Instead of being a permanent team member on a company's payroll, you’re brought in for a specific job with a clear timeline and goal. It's more of a business-to-business relationship, and this single difference is what gives you so much autonomy.

This isn't just a fleeting trend; it's a fundamental change in how companies find and hire talent. The shift has been massive, with remote jobs in the United States tripling since 2020 to now make up over 15% of all job opportunities. This boom shows that companies are eager to tap into a worldwide talent pool, while professionals like you are looking for more control over their work-life balance. For a deeper dive, you can explore more remote work statistics and trends to see just how big this movement has become.

The Contractor and Client Relationship

The entire setup is built on a mutual agreement, all spelled out in a legally binding contract. A client isn't your boss in the traditional sense; they're a partner you're collaborating with to hit a specific business objective.

Here’s what that relationship typically looks like:

- Project-Based Engagements: Your work is tied to specific deliverables, not an endless list of daily tasks. Once the project is done, so is the engagement.

- High Autonomy: You’re the expert. The client cares about the final result, but how you get there is largely up to you, as long as you meet the deadlines and quality standards.

- Flexible Arrangements: Your schedule, the tools you use, and your work methods are your own. This gives you a level of control you just don't get in most salaried roles.

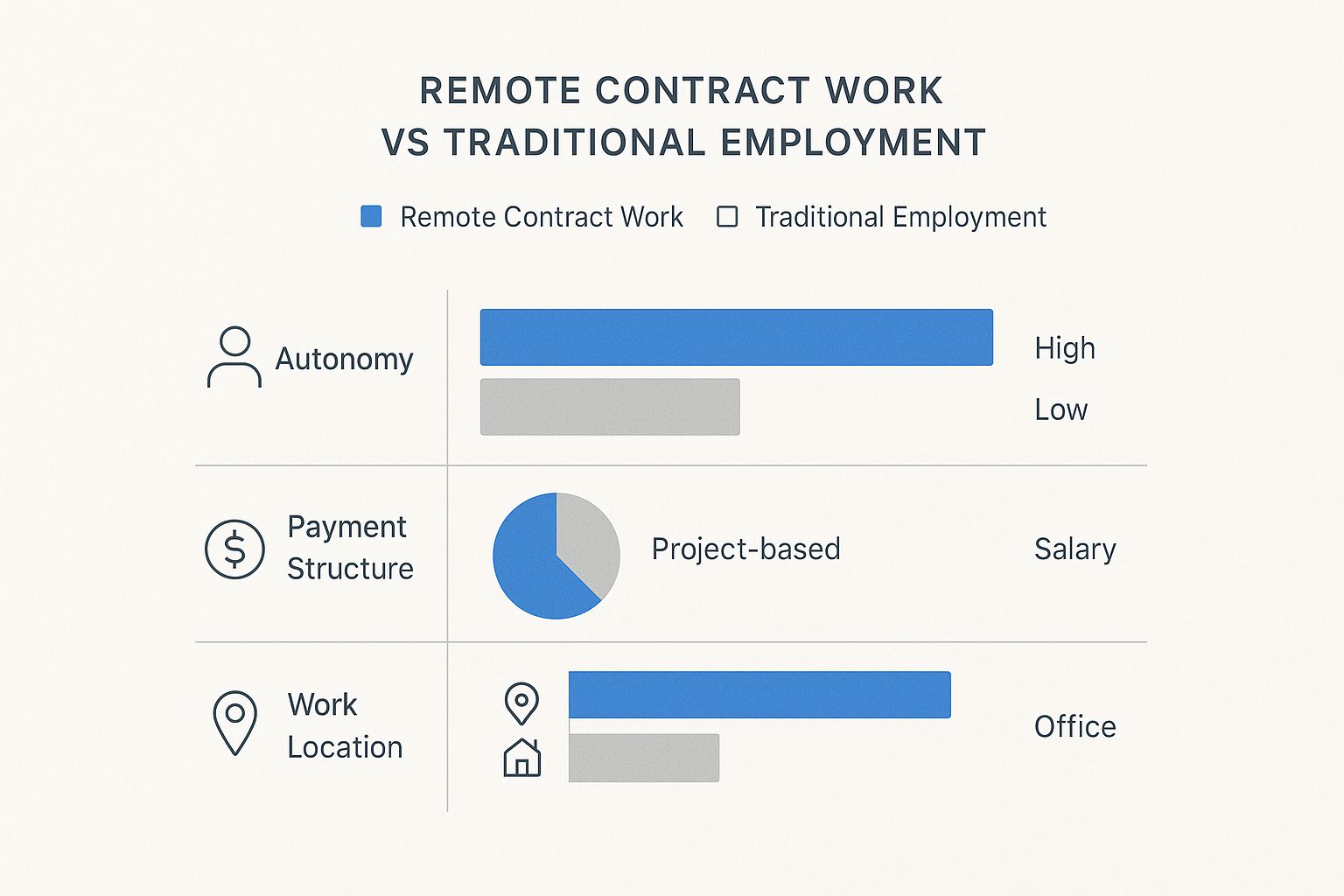

This infographic does a great job of showing the core differences between being a remote contractor and a full-time employee, especially when it comes to freedom, how you get paid, and where you work.

As you can see, traditional jobs offer the comfort of a steady paycheck and a fixed workplace. On the flip side, remote contract work is all about freedom and flexibility. Getting a handle on this trade-off is the very first step to building a career that truly works for you.

Remote Contractor vs Full-Time Employee At a Glance

To make it even clearer, let's break down the key distinctions. While both roles can be remote, the underlying structure is completely different.

| Aspect | Remote Contractor | Full-Time Employee |

|---|---|---|

| Employment Status | Self-employed, a "business of one" | Employed by the company |

| Payment | Invoices for projects or hours | Receives a regular salary |

| Taxes | Responsible for their own taxes (1099) | Taxes withheld by the employer (W-2) |

| Benefits | Must provide their own (health insurance, 401k) | Typically receives a benefits package |

| Job Security | Project-based, less stable | Higher stability, ongoing employment |

| Autonomy | High control over work, schedule, and tools | Follows company policies and direction |

| Equipment | Usually provides their own computer, software, etc. | Company typically provides necessary equipment |

Ultimately, choosing between these paths comes down to what you value most. Do you crave the security and structure of a traditional job, or is the freedom and earning potential of contracting more your style? There’s no right answer—only the one that’s right for you.

Weighing the Freedom and the Risks

Stepping into the world of remote contract work is a bit like being handed the keys to your own career. It’s an exciting mix of incredible freedom and serious personal responsibility. On one side of the coin, you get to design a workday that fits your life. On the other, you suddenly become the CEO, accountant, and sales department for your own one-person business.

The dream is real: imagine taking a month-long trip to a new country, logging in from a beachfront cafe without asking anyone for permission. That kind of flexibility is what pulls most people in. You get the final say on your schedule, the projects you take on, and the clients you choose to work with.

But that level of control comes with a catch. There's no HR department to set up your health insurance or a payroll team to automatically withhold taxes. All of that falls squarely on your shoulders, and it takes a whole new level of self-discipline to manage it all.

The Allure of Autonomy

The biggest draw of remote contracting is the sheer amount of control you gain over your professional life. It goes way beyond just working in your pajamas—it’s about taking true ownership of your career path. You're in the driver's seat, and every decision you make directly shapes your income and your lifestyle.

This means you can:

- Set Your Own Hours: Are you an early bird or a night owl? You can work when you’re sharpest, not just when the clock says you should.

- Choose Your Projects: You get to hunt for work that actually excites you and plays to your strengths, instead of just taking whatever task lands on your desk.

- Determine Your Income: Your earning potential isn’t capped by a rigid salary band. It’s directly tied to the value you deliver and the rates you can confidently charge.

For many, this freedom is a game-changer. It's the ability to build a career that truly supports their life, not the other way around. The power to simply say "no" to a project that isn't the right fit is one of the most underrated perks you'll find.

The Weight of Responsibility

While the freedom is intoxicating, the risks are just as tangible. The steady paycheck and predictable routine of a traditional job are gone, replaced by a constant need for forward-thinking and self-management. All those safety nets an employer provides? They simply don't exist here.

As a contractor, you are 100% responsible for:

- Securing Your Own Benefits: You'll need to research, choose, and pay for your own health insurance, retirement plans, and any time off you plan to take.

- Managing Unpredictable Income: Work often comes in waves. You have to be smart about budgeting for the slow months and prepared for the occasional stress of chasing down an overdue invoice.

- Continuously Finding Work: The hunt for the next project never really stops. This means you have to be networking and marketing your skills on a consistent basis, even when you're busy.

This constant hustle requires you to stay sharp. Unfortunately, the very independence that makes this career so appealing can also make you a target. It’s critical to learn how to spot and steer clear of the common remote job scams that prey on independent professionals.

Ultimately, successfully navigating a contracting career is all about striking a balance between these incredible rewards and very real risks.

Managing Your Contracts and Finances

Succeeding as a remote contractor is about more than just being good at your job. It's about being good at business. When you work for yourself, you're not just the creative talent; you're also the CEO, CFO, and head of legal for your own one-person company.

Getting a handle on your contracts and finances is absolutely essential. These two areas are the bedrock of a stable, long-lasting independent career.

Think of your contract as the project's rulebook. It's not just a piece of paper you sign and forget. It's a critical tool that gets you and your client on the same page, preventing nasty surprises later on. A vague agreement is a one-way ticket to scope creep, late payments, and awkward conversations.

On the flip side, a solid contract builds a foundation of trust right from the start.

Crafting an Ironclad Contract

Your contract needs to be clear, thorough, and fair to both sides. While getting a lawyer to look over your standard template is always a smart move, there are a few core elements that every single agreement must have.

Here's what to include every time:

- Detailed Scope of Work: What, exactly, are you delivering? Be painfully specific about the tasks, the final deliverables, and how many rounds of revision are included. This is your best defense against endless tweaks.

- Payment Terms: Lay out your rate, how and when you'll invoice (e.g., 50% upfront, 50% on completion), and the payment deadline (like NET 15 or NET 30). Don't forget to include a clause for late payment fees.

- Project Timeline: Lock in the start date, any major milestones, and the final due date. It’s all about managing expectations.

- Intellectual Property Rights: This clause clarifies who owns the work once it's paid for. The standard practice is that ownership transfers to the client after you've received the final payment.

A strong contract isn't about mistrust; it's about clarity. It's the ultimate tool for preventing future headaches by ensuring both parties agree on the rules of the engagement before the work even begins.

Navigating Your Financial Responsibilities

Once you start getting paid, you put on your finance hat. As a contractor, you're on your own for taxes, which is a huge shift from being an employee.

The most important habit to build is setting aside money from every single paycheck for taxes. A safe bet is to sock away 25-30% of each invoice to cover your tax bill. This will account for federal and state income taxes, plus the self-employment taxes that cover Social Security and Medicare.

The best way to do this? Open a separate business bank account right away. Keeping your business and personal finances separate makes tracking income and expenses infinitely easier.

Here's the routine: When a client pays you, immediately transfer that tax percentage into a high-yield savings account and don't touch it. This discipline keeps you from accidentally spending the government's money.

You also need to become a meticulous bookkeeper. Tracking every single business expense—from software subscriptions to a portion of your internet bill—can lower your taxable income. For a deeper dive, check out our complete guide on work-from-home tax deductions. Smart financial management is what turns a good income into real profit.

Finding High-Value Remote Contract Gigs

If you want to land truly great remote contract work, you need to look beyond the usual job boards. The truth is, the best opportunities are rarely advertised where everyone else is looking. Finding them is all about smart positioning, active networking, and knowing where the specialized platforms are.

Think of it like fishing. You could cast a massive net into the open ocean and hope you catch something good, which is what you're doing on huge, general job sites. Or, you could find a quiet, well-stocked lake where you know the exact fish you’re after are biting. That’s the power of niche platforms.

Master Niche Freelance Platforms

While the big-name freelance marketplaces have their place, the highest-paying, most interesting projects almost always live on sites built for specific industries. These platforms are curated, connecting top-tier experts with clients who understand—and are willing to pay for—real expertise.

Instead of being a jack-of-all-trades on a giant platform, focus your energy on sites that match your skills perfectly. It immediately positions you as a specialist.

Here’s a breakdown of where to look:

- For Creatives and Marketers: Look for platforms dedicated to design, writing, or marketing. They connect you with clients who need polished, high-quality creative work.

- For Tech Professionals: There are dozens of sites specifically for developers, engineers, and IT pros, offering projects from brand-new startups to Fortune 500 companies.

- For Consultants: You'll find exclusive networks for business strategists, financial advisors, and management consultants that list high-stakes, impactful projects.

By homing in on these specialized environments, you get in front of serious clients who are actively looking for someone with your exact skillset. To narrow your search even further, check out our guide on the best platforms for freelance remote jobs.

Build Your Network Before You Need It

Your professional network is, without a doubt, your most powerful tool. The old saying, "It's not what you know, it's who you know," has never been more true for contract work. Many of the best gigs are never posted publicly; they’re filled through referrals.

This trend is only getting stronger. As companies embrace the flexibility of hiring contractors, they're leaning on trusted recommendations. In fact, there was a 46% increase in contractor engagements from 2023 to 2024, reflecting a more global approach to finding talent. You can see more data on this global shift toward contractor management.

Building your network isn't just about collecting contacts. It's about cultivating genuine relationships. A warm referral from a colleague will almost always beat a cold application.

Start now by being consistently active on professional sites like LinkedIn. Don't just scroll—share your insights, leave thoughtful comments on posts in your field, and connect with peers and potential clients. This helps build your reputation as an expert, so when a contract opportunity comes up, your name is the first one that comes to mind. It's a proactive approach that lets the best remote contract work find you.

Building a Sustainable Contracting Career

To really thrive as a remote contractor, you have to think beyond just landing the next gig. The goal is building a real, sustainable business that stands the test of time. This means making a mental shift—you're not just a temporary worker; you're the CEO of your own company. The best in the business don't just wait for opportunities to fall into their laps; they actively create them.

Your personal brand is essentially your professional reputation. It’s what people say about you when you're not in the room and what makes a client pick you over a dozen other qualified candidates. A solid brand is built on a foundation of consistently great work, crystal-clear communication, and a unique professional identity that pulls in the exact kind of clients you want to work with.

Develop Your Personal Brand and Network

Think of your brand as your professional narrative. It needs to tell a clear, compelling story about who you are, what you're an expert in, and the specific value you deliver. The first step is to nail down your niche. From there, you can consistently put your expertise on display through a polished portfolio, an active LinkedIn presence, and by sharing genuinely helpful insights with your industry community.

A strong brand is a magnet for a strong network. It's not just about collecting contacts; it's about nurturing real relationships. Offer help without expecting anything in return, celebrate the wins of your peers, and make an effort to stay in touch. Before you know it, your network will become your most powerful marketing channel, sending high-quality referrals and projects your way.

The freedom of remote contract work is also fundamentally changing how people think about their careers and lives. Right now, 20% of remote workers are planning to move to a new location purely for lifestyle reasons. This trend is particularly popular with millennials, who are flocking to places like Spain and Portugal. It’s a clear sign that professionals are now designing their lives first and fitting their careers into that vision, not the other way around. You can learn more about this global workforce migration and what it means for the future.

Strategically Price and Invest in Yourself

Figuring out what to charge is one of the most important decisions you'll make as a business owner. Your pricing should be rooted in the value you provide, not just the hours you put in. Do your homework to see what the market rates are for your specific skills, and then confidently set a rate that reflects your expertise while also covering your business expenses, taxes, and personal savings goals.

Never be afraid to increase your rates as you gain more experience and sharpen your skills. Bumping up your price for new clients, or even for existing ones after you've delivered incredible results, is a perfectly normal—and necessary—part of growing a healthy contracting business.

At the end of the day, the best investment you can ever make is in yourself. Your skills are your greatest asset. Set aside time and money for continuous learning, whether it's through online courses, getting a new certification, or attending industry conferences. Keeping your skills sharp and staying ahead of new trends is what keeps you in high demand. It empowers you to charge premium rates and be selective about your projects, turning what started as a gig into a career you can be proud of for years to come.

Got Questions? We've Got Answers

Stepping into the world of remote contracting can feel like learning a new language. You're not alone if you have questions—in fact, most people do. Let's clear up a few of the most common ones.

How Do I Figure Out My Rate When I’m Just Starting?

Setting your rate for the first time is less of a dark art and more of a simple calculation. A great way to start is to think about the annual salary you'd want in a traditional job.

Take that number and add about 25-30% on top. This extra cushion isn't for fun; it's to cover crucial costs you're now responsible for, like self-employment taxes, health insurance, and retirement savings.

Once you have that new, higher number, divide it by the hours you realistically plan to work in a year (around 1,800 is a solid baseline for a full-time contractor). This gives you a great starting hourly rate. Finally, do a quick sanity check by researching what others with your skills are charging to make sure you're in the right ballpark.

What's the Real Difference Between a 1099 and a W-2 Worker?

These tax forms basically define your relationship with the company paying you. If you're a W-2 worker, you're a classic employee. The company handles withholding taxes from your paycheck, so you don't have to think much about it.

As a 1099 worker, you're an independent contractor. You're your own boss, which also means you're your own payroll department. You get paid the full amount you bill, and it's up to you to set aside money for and pay your own income and self-employment taxes. Any client that pays you over $600 in a year will send you a 1099-NEC form, which is what you'll use to report that income to the IRS.

At its core, the difference is all about responsibility. A 1099 contractor is a business of one. You’re in charge of your own tax compliance, which usually means making estimated payments to the IRS every quarter.

How Do I Handle an Income That Goes Up and Down?

The feast-or-famine cycle is a real concern for contractors, but you can absolutely smooth it out with a little planning. The single most powerful tool you have is a financial buffer.

Your goal should be to save enough to cover 3-6 months of essential living expenses. This isn't just a "nice-to-have"; it's the foundation of a stable contracting career.

Get into the habit of automatically moving a percentage of every single payment you receive into a separate savings account. When you have a great month, resist the urge to spend it all. Instead, use the extra cash to bulk up your tax savings and that emergency fund. This discipline is what turns unpredictable income into a steady, reliable resource.

Ready to put this knowledge to work? At RemoteWeek, we specialize in connecting talented professionals with high-quality remote contract opportunities. Check out thousands of hand-picked listings and find your next great gig. Visit our job board to get started.