Your Guide to Avoiding Work From Home Job Scams

So, what exactly is a work-from-home job scam? It's a fake job offer designed to do one thing: steal from you. Scammers aren't offering a real career; they're setting a trap to get your money, your personal information, or trick you into doing something illegal.

They might ask for money upfront for "training" or "equipment," demand your bank account details for a "direct deposit" that never comes, or ask you to handle financial transactions that turn out to be part of a money-laundering scheme.

The Hidden Dangers in Your Remote Job Search

Landing a great remote job is a goal for millions, but this surge in demand has also attracted a less savory crowd: scammers. These aren't just pushing poorly paid gigs; they're running sophisticated operations to take advantage of hopeful job seekers. Think of them as predators in the digital wilderness, using the logos of legitimate companies and the promise of a big paycheck as bait.

The numbers are genuinely shocking. A study from the Better Business Bureau (BBB) revealed that a staggering 14 million people face employment scams every year, leading to $2 billion in losses. The full BBB study shows that these scams often hit the most vulnerable, with 66.7% of complaints filed by women and 54% of victims being unemployed when they were targeted.

Distinguishing Scams from Bad Jobs

It’s important to draw a line between a genuinely bad job and a flat-out scam. A bad job might come with low pay, a micromanager from hell, or vague responsibilities—but it's still a real job. You get a paycheck for doing actual work.

A work-from-home scam is entirely different. Its purpose isn't employment; it's theft.

A legitimate remote company invests in you. A scammer demands you invest in them first.

Remembering this simple rule is your best defense. A real employer pays for your background check, sends you a company-owned laptop, and handles training costs. A scammer will flip the script and ask you to pay for those things.

The Psychological Manipulation at Play

Scammers are experts at playing on your emotions. They know that during a job hunt, you’re often feeling hopeful, maybe a little anxious, and eager to find the right opportunity. They build their traps around these feelings.

Here’s a look at their common tactics:

- Promise of High Reward for Low Effort: They dangle offers with unbelievably high salaries for simple tasks like data entry or reshipping packages. It’s designed to feel like you've just hit the jackpot.

- Creation of False Urgency: "We need to fill this role by tomorrow!" Scammers rush you through the process, giving you no time to think, ask questions, or do your own research.

- Exploitation of Trust: They often impersonate recruiters from big, recognizable companies—think Google, Amazon, or Apple—to make the offer seem credible and put you at ease.

Once you know their playbook, you can spot these red flags from a mile away. It’s the first step to confidently navigating the remote job market and avoiding the traps.

Getting Inside the Scammer's Head

If you want to dodge a remote job scam, you have to learn to think like the person running it. These aren't just lazy attempts to trick people; they're elaborate productions. Scammers are storytellers, creating an entire fake experience with scripts, fake colleagues, and convincing documents designed to win your trust before they take your money.

Getting familiar with their playbook is your best defense. It helps you look past the tempting salary and flexible schedule to see the scam for what it is. Let's break down the most common and damaging schemes out there right now.

The Classic: Pay for Your Own Equipment

This is one of the oldest tricks in the book, but it still works because it plays on a job seeker's excitement. Here’s how it usually goes: you land a fantastic job offer, often after a suspiciously quick "interview" over a messaging app. Everything seems perfect... until the very last step.

Your new "hiring manager" tells you that you need to buy specific equipment or software to get started. They might even send you a check to cover the costs, telling you to deposit it and then immediately wire the money to their "approved vendor." The problem is, the check is a fake. It might seem to clear at first, but a few days later, it bounces. By then, your real money is long gone, sent directly to the scammer.

- The Lure: A great job offer and a check that temporarily inflates your bank balance.

- The Trick: The vendor is just the scammer in disguise, and the check is worthless.

- The Damage: You're left with a negative bank account and no job.

The New Favorite: Task-Based Scams

This newer scam is far more clever because it feels like a rigged carnival game where you're allowed to win a few small prizes first. You're drawn in with simple tasks that offer quick, real payouts. The goal is to build your confidence so you'll trust the system before they ask for a much bigger "investment."

It might start with something easy, like "optimizing" data by liking social media posts or leaving positive reviews. You complete a small batch and get paid a small commission, maybe $50 or $100. Once you're hooked, your "manager" introduces higher-paying tasks that require you to first deposit your own money into a crypto wallet or a special platform to "unlock" them.

They’ll say something like, "Deposit $500 to unlock a task bundle that pays out $800!" The first time, it actually works. You get your money back, plus a nice profit. But the next deposit will be bigger—$5,000, then $10,000. Sooner or later, you'll hit a wall. Either you'll be asked to deposit an impossible amount to continue, or your account will be frozen for a bogus "tax violation," and every dollar you put in will vanish.

This slow, methodical process is designed to wear down your skepticism. By giving you a few small wins, scammers get you to lower your guard until you’re willing to risk thousands for the promise of an even bigger payday.

The Federal Trade Commission (FTC) has seen an explosion in these scams. Losses from job scams tripled between 2020 and 2023, mostly because of these "task scams" that rope victims into crypto-based cons. You can dig into more of the data on how these scams cost people millions over on Bitdefender’s security blog.

The Unwitting Accomplice: Money Mule Schemes

This is easily the most dangerous work-from-home scam, because it can turn you into a criminal without you even knowing it. The job usually has a title like "payment processor" or "reshipping manager." Your task is simple: receive money into your personal bank account, then transfer it somewhere else (often overseas), keeping a small cut for yourself.

What you don't know is that you're laundering stolen money. The funds coming into your account are from other crimes, like hacked bank accounts. When the police start investigating, the trail leads straight to you.

- Job Titles to Watch For: "Logistics Manager," "Payment Coordinator," "Package Handler."

- The Red Flag: Any job that requires you to receive and forward money or goods using your personal accounts.

- The Fallout: Your bank account gets frozen, and you could face serious legal charges for being part of a criminal operation.

Once you know the basic structure of these schemes—the initial trust-building, the slow escalation of requests, and the manipulation of financial systems—you can spot them from a mile away and keep yourself safe.

Critical Red Flags That Signal a Scam

Knowing the common types of work-from-home scams is a great start, but the real skill is learning to spot the warning signs they leave behind. Think of these red flags as a scammer's "tell"—those little unintentional clues that give away their entire game. Once you train yourself to recognize these signs, you can instantly dismiss fake opportunities and protect your time, money, and personal info.

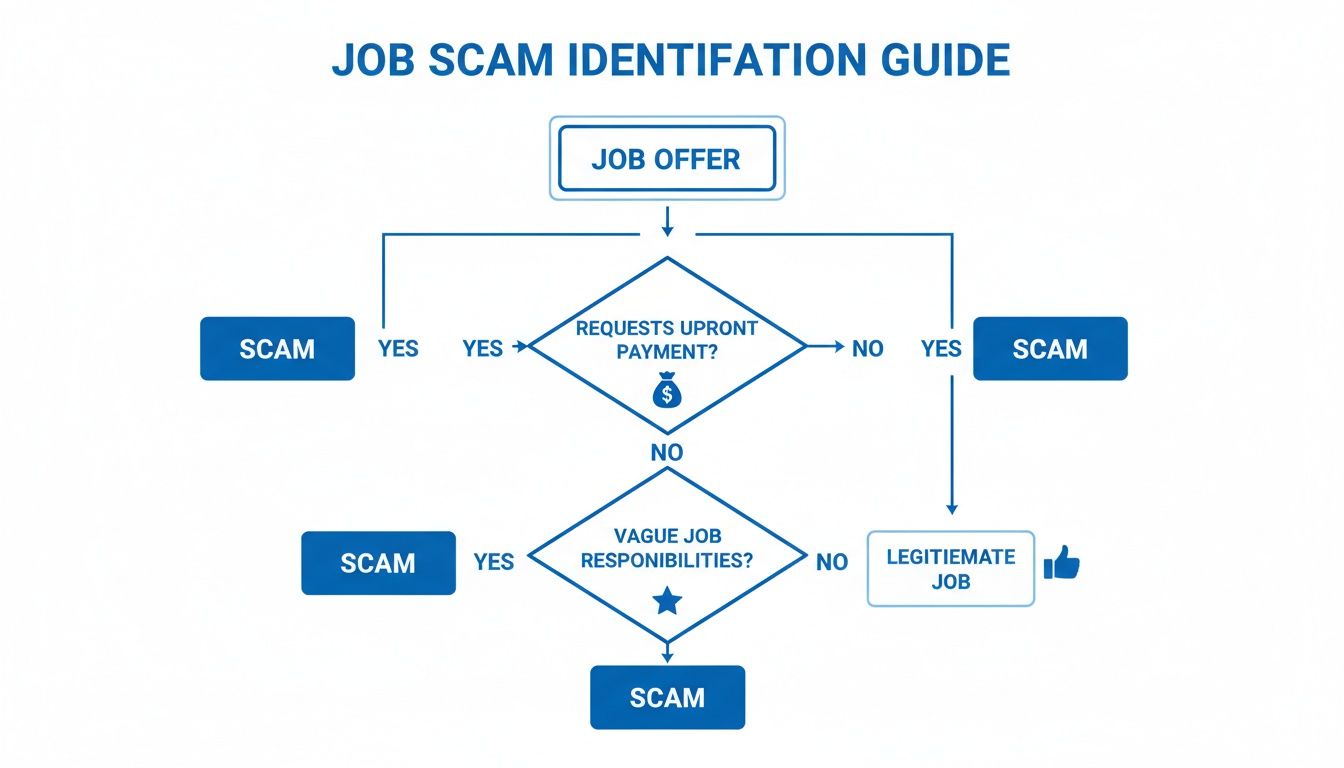

This flowchart breaks down the simple questions that can quickly separate a real job from a trap.

As you can see, demanding money or being deliberately vague are two of the quickest ways to identify a potential scam.

Unprofessional and Urgent Communication

Legitimate companies invest time and money into a professional hiring process. Scammers, on the other hand, are all about speed and cutting corners, which usually leaves a trail of sloppy communication.

Be immediately suspicious of job offers that pop up in unsolicited social media DMs or text messages. Real recruiters almost always use official channels, like an email from a corporate domain (think recruiter@companyname.com, not companyname.hiring@gmail.com) or a message through LinkedIn.

The little details matter, so pay close attention:

- Poor Grammar and Spelling: A single typo can happen to anyone. But a job description riddled with errors is a huge red flag.

- Informal Chat App Interviews: A serious company will want to interview you over a video call or phone, not exclusively on apps like WhatsApp, Signal, or Telegram.

- Extreme Urgency: If you see phrases like "You must accept today!" or "This is a limited-time offer," it's a classic pressure tactic. They want to rush you so you don't have time to think clearly or do your own research.

A professional hiring process is patient and thorough. Scammers create a sense of panic to force you into making a mistake. A rushed timeline is almost always a sign that something is wrong.

Vague Job Descriptions with High Pay

One of the most powerful lures scammers use is dangling an incredible salary for a job that requires little to no experience. It’s the oldest trick in the book: if an offer sounds too good to be true, it almost certainly is.

Scammers are masters of being vague. They’ll use generic titles like "Data Entry Clerk" or "Administrative Assistant" but won't provide any specific details about what you'd actually be doing day-to-day. A real job posting outlines clear duties, required skills, and what's expected of you. A scam ad just focuses on the easy money. Learning to read between the lines is a key skill, and you might find it helpful to look through some real work from home reviews to see what legitimate roles look like.

Suspicious Financial Requests

This is the biggest, brightest red flag of them all. A legitimate employer will never ask you to pay money to get a job. This is a non-negotiable rule.

Scammers have an endless list of excuses for why you need to open your wallet:

- Upfront Fees: They might ask you to pay for training materials, background checks, or special software. A real employer always covers these costs.

- Equipment Purchases: They might send you a fake check and tell you to buy equipment from their "approved vendor." By the time your bank realizes the check is fraudulent, you've already sent your real money to the scammer.

- Bank Account Information: Never, ever provide your bank details before you have signed a formal, verifiable employment contract.

Statistics back this up. One security study found that 41.1% of fraudulent job posts used suspicious contact information, 25.7% offered unrealistically high salaries, and 7.3% demanded upfront payments. With remote jobs being the most targeted category, these signs are more important than ever to watch for. You can explore the full job scam study on Heimdal Security's blog for a deeper dive into the data.

Job Scam Red Flag Checklist

When you're looking at a new job opportunity, it helps to have a mental checklist. Run through these points to see if anything feels off. If you find yourself ticking several of these boxes, it's time to walk away.

| Category | Red Flag to Watch For | What It Likely Means |

|---|---|---|

| Communication | Unsolicited contact via text or social media DMs. | The "recruiter" is likely a scammer using burner accounts to spam potential victims. |

| Communication | Emails from a generic domain (e.g., Gmail, Yahoo) instead of a corporate one. | The person isn't associated with the company they claim to represent. |

| Communication | Constant grammar mistakes, spelling errors, and unprofessional language. | The job post was hastily created by scammers, often overseas, who lack professional writing skills. |

| Job Details | The job description is extremely vague about your actual duties and responsibilities. | They don't have a real job to offer; they just need a generic hook to lure people in. |

| Job Details | The pay is exceptionally high for a role that requires little or no experience. | It's a classic "too good to be true" tactic designed to make you overlook other red flags. |

| Job Details | You're offered the job on the spot with no real interview process. | Legitimate companies vet their candidates. An instant offer means they don't care who you are, just what they can get from you. |

| Financial Requests | You're asked to pay for training, a background check, or equipment upfront. | This is the #1 sign of a scam. Real employers pay for their employees' onboarding costs. |

| Financial Requests | You receive a check and are told to deposit it and wire some of the money elsewhere. | This is a classic fake check scam. The check will bounce, and you'll be responsible for the money you sent. |

| Financial Requests | You're pressured to provide your bank account details before signing a contract. | The scammer is trying to get direct access to your finances for identity theft or fraudulent withdrawals. |

This checklist isn't exhaustive, but it covers the most common and dangerous signs. Trust your gut—if an offer feels wrong, it probably is. It's always better to be overly cautious and miss out on a questionable "opportunity" than to become a victim of fraud.

Your Proactive Vetting and Protection Strategy

Spotting the red flags of a work-from-home job scam is a great first defense, but the best approach is to get ahead of the scammers entirely. Instead of waiting for something to feel "off," you can take control by thoroughly vetting every single opportunity before you even think about applying.

Think of it as doing a background check on the company, just like they’d do on you. This isn't about being paranoid; it's about being a savvy professional in a world where con artists are getting more and more sophisticated. By creating a consistent vetting checklist, you can confidently weed out the fake listings and focus your energy on the real, exciting remote jobs.

Investigating the Company’s Digital Footprint

A real company leaves a real trail online. A scammer’s trail, on the other hand, is usually shallow, inconsistent, or suspiciously new. Your first move is to put on your detective hat and investigate the company’s official presence.

Start with a simple web search for the company's name. A legitimate business will have a professional, polished website. Comb through the site—is there a physical address? A real phone number? A dedicated careers page? Scammers often throw together generic-looking sites with no actual contact info.

Next, head over to LinkedIn. Any reputable company will have a detailed LinkedIn page, complete with employee profiles you can browse, recent activity, and a company history that goes back more than a few months. Cross-reference the name of the recruiter who contacted you. If you can’t find them on LinkedIn or their profile looks like it was created last week, that’s a huge red flag.

Verifying the People Behind the Offer

Scammers love to hide behind fake profiles and stolen identities. A few simple verification tricks can expose them pretty quickly.

If a recruiter sends you a professional headshot, run it through a reverse image search on a tool like Google Images. This will instantly tell you if the picture is just a generic stock photo or, worse, stolen from an unsuspecting person's social media profile. Scammers rarely use their own faces.

Also, pay very close attention to the email address. A real recruiter will almost always email you from a corporate domain (like jane.doe@company.com). Be extremely skeptical of any messages coming from generic providers like Gmail, Yahoo, or Outlook, even if the username seems plausible.

Scammers have a nasty trick of creating email addresses that are just one character off from the real thing, like jane.doe@cornpany.com, hoping you won't notice the typo. Always double-check the domain against the company's official website.

Your Personal Digital Safety Checklist

Protecting yourself also means locking down your own information. Good digital hygiene during your job search is non-negotiable. A key part of your strategy should involve understanding the practical steps for preventing identity fraud.

Follow these essential rules to keep your data out of the wrong hands:

- Use Unique Passwords: Never reuse passwords. Create a different, strong password for every single job site you use. If one site gets breached, this simple step stops scammers from getting into your other accounts.

- Never Click Suspicious Links: Don’t click on links or download attachments in emails or messages you weren't expecting. If a recruiter tells you about a job opening, go to the company’s official website and find the listing there yourself.

- Guard Your Personal Information: Never, ever give out your Social Security number, bank account details, or a copy of your ID before you have a signed, legitimate employment contract in hand. A real company will only ask for this sensitive information after you’ve been formally hired.

Making these practices a habit will not only protect you from current threats but also build a solid foundation for your security in the long run. For a deeper dive into protecting your digital life, check out our guide on essential cybersecurity for remote workers. These simple, proactive steps can make all the difference in keeping your remote job search safe and successful.

What to Do When You Encounter a Job Scam

That sinking feeling when you realize a promising job opportunity is actually a scam is awful. Whether you just noticed the red flags or you've already sent money, it's easy to panic. But the key is to act fast and follow a clear plan to protect yourself.

The very first thing you need to do is simple: cut off all contact immediately. Stop replying to emails and messages. Don't answer their calls. Block their number, email address, and any social media profiles they used to contact you. Trying to reason with them or call them out only opens the door for more manipulation.

Secure Your Finances and Identity

If you handed over any bank details, credit card numbers, or sent them money, your next move is all about damage control. Time is absolutely critical here.

Contact Your Bank or Financial Institution: Get on the phone with the fraud department for your bank, credit card, or any payment service you used, like PayPal or Zelle. Explain what happened, report the fraudulent transaction, and ask if they can reverse the payment. They can also put a temporary freeze on your accounts to stop any more money from going out.

Place a Fraud Alert on Your Credit: Call one of the three major credit bureaus—Equifax, Experian, or TransUnion. You only need to contact one; they are legally required to notify the other two. A fraud alert makes it much harder for someone to open a new credit card or get a loan in your name.

Secure Your Online Accounts: Did you give them a password or personal info they could use to guess one? Change the passwords for all your critical accounts right away, starting with your email and online banking. Make sure you use strong, unique passwords for every site to keep the damage contained.

By acting decisively, you create a firewall between the scammer and your assets. The goal is to shut down their access as quickly as possible, protecting your finances and personal information from further harm.

Report the Scam to the Authorities

Reporting what happened is more than just a formality. It helps law enforcement track these criminals and prevents other people from falling into the same trap. You might not get your money back, but your report adds a crucial piece to the puzzle for the agencies fighting these crimes.

You don't have to pick just one place to report it. In fact, filing reports with multiple agencies makes the case against the scammers even stronger.

Here’s where you should file a report:

- The Federal Trade Commission (FTC): This is the main government agency for collecting scam reports. You can file a complaint directly on their official site at ReportFraud.ftc.gov.

- The FBI's Internet Crime Complaint Center (IC3): If the scam happened online and involved a significant financial loss, you’ll want to file a report with the IC3.

- The Better Business Bureau (BBB): Head over to the BBB Scam Tracker to report the scam. This is a great way to warn others in your community about the specific company name or tactics being used.

- The Job Board or Social Media Platform: Always report the fake job posting on the platform where you found it. Whether it was on LinkedIn, Facebook, or another job site, reporting it helps them take the listing down before it snares someone else.

It can feel like a lot to handle, but following these steps gives you a clear path forward. You can take back control of the situation and do your part to stop these scammers in their tracks.

How to Find Legitimate and Vetted Remote Work

Trying to dodge work-from-home scams can feel like a full-time job in itself. It's exhausting, but don't let it discourage you from landing a fantastic remote role. The secret is to change where you’re looking—moving away from wide-open, unvetted platforms to ones that put safety and quality first.

Think of it this way: you could buy produce from a random street stall where you’re not sure about the quality, or you could shop at a grocery store that vets its suppliers. Curated job boards are like that trusted grocery store. They do the heavy lifting on safety checks, so you can just focus on finding a job you’ll love.

The Power of a Vetting Process

This is where specialized job platforms really shine. They're built to filter out the scams and low-quality listings. Instead of letting just anyone post a job, they have a serious vetting process. This isn't just a quick glance; it's a deep dive to make sure a company is legitimate, financially stable, and has a good reputation.

Here's what that process usually looks like:

- Company Verification: Is this a real business? They’ll check for official registration, a solid online footprint, and a legitimate corporate address.

- Reputation Analysis: They dig into employee reviews and ratings on sites like Glassdoor. Some platforms will only feature companies with high satisfaction scores, which is a great way to weed out toxic work environments from the get-go.

- Job Post Scrutiny: The job description itself is put under the microscope. They look for clear language, realistic salary ranges, and professional tone, flagging anything that matches the red flags we covered earlier.

This flips the script on your job search. You can stop playing defense, constantly on the lookout for scams, and start playing offense—applying to great roles with confidence.

Choosing Safer Job Search Platforms

Most scams run wild on the massive, open job sites and social media marketplaces. It's the "wild west" out there. These platforms often don't have the resources or motivation to police every single post, making them a playground for fraudsters.

A curated job board’s entire business model is built on trust. Their reputation depends on the quality and safety of their listings, which creates a much more secure space for job seekers.

When you use a platform that vets its job posts, you’re not just scrolling through a random list. You’re looking at opportunities from companies that have already passed a quality inspection. If you're looking for trusted places to start, resources that list Top Platforms for Legit Remote Work for those new to remote work can be incredibly helpful.

Searching with Confidence and Peace of Mind

At the end of the day, this is all about putting you back in control. By sticking to platforms that make your safety a priority, you sidestep the vast majority of scams. No more second-guessing every email or worrying that a great-sounding offer is actually a trap.

You can finally search with peace of mind, knowing the opportunities you’re seeing are legitimate. This frees you up to pour your energy into what really matters: writing a standout application, nailing your interviews, and finding a remote job that’s a perfect fit. If you're ready to start exploring these safer options, our guide on where you can find jobs working from home is the perfect place to begin.

Common Questions About Work-From-Home Job Scams

When you're deep in the remote job hunt, a few tricky questions always seem to pop up. Let's tackle some of the most common things people wonder about when trying to separate a real opportunity from a clever scam.

Can a Legitimate Company Ask Me to Pay for Anything?

This is a big one, and the answer is all about the details. A real employer will never ask you to pay them directly for a job, training materials, or company software. Think of it this way: those are just the costs of doing business, and it's their responsibility to cover them.

Now, this is different from a standard reimbursement. A legitimate company might ask you to buy a specific headset or some other small piece of equipment and then pay you back for it on your first paycheck. The crucial difference is who gets the money and when. A scammer wants you to pay them (or their fake "vendor") upfront. A real job reimburses you for an approved expense after you're already on the team.

Are Scams Only Targeting Entry-Level Applicants?

That's a dangerous myth. Scammers are equal-opportunity fraudsters—they create convincing fake roles for everyone, from recent grads to C-suite executives.

In fact, some of the most elaborate schemes target seasoned professionals with fake senior-level postings promising huge six-figure salaries. They bank on the fact that experienced candidates might not question a complicated onboarding process, making them vulnerable to scams designed to steal much larger amounts of money. No matter where you are in your career, you have to stay sharp.

How Can I Verify a Recruiter Who Contacted Me?

Got an unexpected message from a recruiter? It's smart to put your detective hat on before you reply. Here’s a quick mental checklist to run through:

- Check Their Digital Footprint: Find the recruiter on LinkedIn. Does their profile look real and match the company they say they work for? Then, pop over to the company's official website and see if you can find them listed there.

- Verify Their Email Address: Look closely at their email address. A message from a corporate domain (like jane.doe@company.com) is what you want to see. An email from a generic address (like company.careers@gmail.com) is a massive red flag.

- Ask for a Video Call: Scammers love hiding behind text-only apps like Signal or Telegram. The easiest way to cut through the noise is to insist on a video call. A real recruiter won't bat an eye; a scammer will almost always have an excuse.

At RemoteWeek, we take this guesswork out of the equation. Every single company on our job board is carefully pre-vetted by our team. We focus on high-quality, employee-first remote roles so you can apply with confidence, knowing every opportunity is the real deal.

Start your risk-free job search and find your next great remote role at https://www.remoteweek.io.