How to Compare Job Offers A Guide for Tech Professionals

Congratulations! Having multiple job offers in hand is an amazing position to be in. It's also where the real work begins. The temptation is to jump at the highest salary, but learning how to compare job offers is about looking at the entire picture—not just the paycheck.

You need a solid framework to weigh total compensation, career growth, company culture, and remote policies. This is how you find the role that genuinely fits your life and long-term goals.

Your Framework for Comparing Job Offers

Juggling more than one opportunity is a great problem to have, but it can get overwhelming fast. That initial rush of excitement can easily turn into analysis paralysis if you don't have a plan. The best way to cut through the noise is to get organized and create a structured way to compare everything side-by-side.

Think of it this way: you're not just picking the "best" offer on paper. You're trying to find the best fit for you, right now, in your career. A higher salary might look like the clear winner, but it can sometimes hide trade-offs like poor mentorship, a brutal on-call schedule, or a culture that just doesn't vibe with you. Those are the things that lead to burnout.

Building Your Evaluation System

The first move is to break each offer down into its core pieces. This disciplined approach helps you compare apples to apples and stops you from getting dazzled by one big number. Your evaluation should stand on a few key pillars:

- Total Compensation: Go beyond base pay. Look at bonuses, equity, and any 401(k) matching.

- Benefits Package: Dig into healthcare coverage, PTO policies, and any wellness perks.

- Growth and Stability: How's the company doing in the market? What does your career path look like?

- Culture and Manager Fit: This is huge. Think about team dynamics, how they communicate, and the support you'll get from your boss.

By looking at each of these areas systematically, you shift from making a gut decision to a data-driven one. This resource offers a great deep dive on how to evaluate a job offer and all its moving parts.

The right job should be a catalyst for your career, helping you build skills and confidence—not just a bigger paycheck that leads to exhaustion. Your first role at a new company sets the tone for your future there.

Create a Quick Job Offer Comparison Checklist

To get the ball rolling, a simple side-by-side checklist is your best friend. It helps you visualize the pros and cons of each opportunity, which brings a ton of clarity to the decision-making process.

Here’s a simple table to get you started:

| Comparison Point | Offer A Details | Offer B Details |

|---|---|---|

| Base Salary | Enter the annual salary figure here. | Enter the annual salary figure here. |

| Bonus Potential | Note any performance or sign-on bonuses. | Note any performance or sign-on bonuses. |

| Equity (RSUs/Options) | Detail the grant value and vesting schedule. | Detail the grant value and vesting schedule. |

| Healthcare Premiums | List your estimated monthly cost. | List your estimated monthly cost. |

| Paid Time Off (PTO) | State the total number of vacation/sick days. | State the total number of vacation/sick days. |

| Remote Work Policy | Is it fully remote, hybrid, or office-based? | Is it fully remote, hybrid, or office-based? |

| Key Pro | List the single biggest advantage of this offer. | List the single biggest advantage of this offer. |

| Key Con | Note the most significant drawback. | Note the most significant drawback. |

This checklist is just the foundation. In the next few sections, we’ll go much deeper into each of these categories, giving you the tools to analyze every last detail with precision.

Deconstructing the Total Compensation Package

When a job offer lands in your inbox, your eyes naturally jump to the base salary. It's the big, bold number, and it's easy to let it overshadow everything else. But experienced pros know that salary is just one piece of a much larger, more complex financial puzzle.

To really get a feel for an offer's true worth, you have to look at the whole picture—the total compensation. A monster base salary can sometimes hide weak bonuses or non-existent equity. On the flip side, a slightly lower salary might come with an incredible opportunity to build long-term wealth. Your mission is to calculate the complete financial value, not just for year one, but for the years to come.

Looking Past the Base Salary

Your base salary is your bedrock. It's the guaranteed income you can count on, the foundation for your budget and financial planning. But it should never be the only number you look at.

The first thing you should do is benchmark that salary. How does it stack up against the industry average for your specific role, experience, and even your location? Yes, even with remote roles, some companies still adjust pay based on cost of living, so that’s a factor.

This is more important than ever. With an estimated 73 million remote-capable jobs now available globally, the game has changed. We're not just comparing salaries anymore; we're comparing the whole remote work experience. Knowing your market value gives you the confidence to know if an offer is genuinely competitive or just average.

The Role of Bonuses and Incentives

Bonuses are where things start to get interesting—and a little tricky. They introduce variability into your earnings, so you need to know exactly what you’re dealing with. It’s crucial to separate the one-time cash from the recurring performance-based pay.

Sign-On Bonus: This is a one-off payment designed to get you in the door. It’s a fantastic perk, but don't forget it disappears after year one. Always ask if there's a clawback clause. Many companies require you to pay it back if you leave within a specific period, usually the first year.

Performance Bonus: This is your recurring, annual bonus tied to how well you and the company perform. You need to dig into the details here. Is it guaranteed or discretionary? What was the average payout for this role over the past few years? A "target bonus of 15%" sounds amazing, but if the company has only hit 50% of that target for three years running, you need to be realistic in your projections.

A hefty sign-on bonus can certainly soften the blow of a lower base salary in your first year. But a consistent, reliable annual bonus will have a far greater impact on your earnings over the long haul.

Understanding Equity and Its Long-Term Value

For anyone in tech, equity is often the most powerful—and most complicated—part of a compensation package. It’s your slice of ownership in the company, and it can be the ticket to serious financial gains if the company does well.

Going beyond salary requires understanding employee stock options and RSUs. This isn't cash in hand; it's a promise of future value, and you need to know how to evaluate that promise.

Here's a quick rundown of what you'll usually see:

- Restricted Stock Units (RSUs): The company grants you shares that become fully yours over time based on a vesting schedule. Once vested, they're just like any other shares of stock you own.

- Incentive Stock Options (ISOs): These grant you the right to buy company stock at a set "strike price" down the road. The profit comes from the difference between your low strike price and the higher market price when you eventually sell.

The vesting schedule is a make-or-break detail. A typical setup is a four-year schedule with a one-year "cliff." This means if you leave before your first anniversary, you get nothing. After that one-year cliff, you might get 25% of your grant, with the rest vesting in chunks every month or quarter after that.

Let’s look at a real-world comparison:

- Offer A: $160,000 base salary + 10% target bonus, but zero equity.

- Offer B: $145,000 base salary + 10% target bonus + $100,000 in RSUs vesting over four years.

Offer A puts more cash in your pocket right away. But Offer B adds an average of $25,000 per year in equity value (assuming the stock price doesn't change). If you believe in the company's growth potential, that equity could be worth far more in a few years, making Offer B the clear winner for building long-term wealth. A big part of this decision comes down to your faith in the company's future.

Evaluating Benefits Beyond the Paycheck

A competitive salary is a great starting point, but the benefits package is where you see how a company really invests in its people. These perks aren't just fluff; they're a huge part of your total compensation and directly impact your wallet and your quality of life. To truly compare job offers, you have to assign a real, tangible value to these non-salary items.

For remote tech pros, certain benefits just mean more. A solid home office stipend or generous, flexible paid time off (PTO) can make a much bigger difference in your day-to-day than a minor salary bump. The goal is to put a number on these perks to see which offer truly comes out ahead.

Valuing Your Healthcare Coverage

Health insurance is often the heaviest hitter in any benefits package and, frankly, the most complicated to evaluate. The gap between a great plan and a mediocre one can easily add up to thousands of dollars a year in out-of-pocket costs. Don’t just glance at what the company contributes—you need to dive into the details.

Ask HR for the full plan summaries for health, dental, and vision. You'll want to zero in on three key figures:

- Monthly Premiums: This is the fixed amount that comes out of your paycheck. A company that covers 100% of premiums for both you and your family is handing you a massive financial win.

- Deductibles: This is what you have to pay yourself before the insurance company starts picking up the bigger bills. A high-deductible plan might look cheap with its low premiums, but one unexpected medical event could hit you hard.

- Out-of-Pocket Maximum: This is the absolute ceiling on what you’ll pay for covered services in a year. A lower maximum acts as a critical financial safety net.

If you’re looking at international remote roles, things get even trickier. You absolutely must clarify whether the company’s insurance provides solid coverage in your country or if you'll be getting a stipend to find your own plan.

Quantifying Retirement and Financial Perks

A good retirement plan is a direct investment in your future, and a company match is literally free money. The most common setup is a 401(k) match, where your employer puts in money when you do, up to a certain percentage of your salary.

Let's look at a quick comparison:

- Company A: Offers a $140,000 salary, but no 401(k) match.

- Company B: Offers a $135,000 salary, but they match 100% of your 401(k) contributions up to 6% of your salary.

With Company B, if you put in 6% of your salary ($8,100), they'll kick in another $8,100. That match just bumped your effective first-year compensation to $143,100, making it the clear long-term winner.

A strong 401(k) match is one of the most powerful wealth-building tools you'll ever have. Overlooking it is like turning down a guaranteed raise every single year.

The Perks That Power Remote Success

Beyond the big-ticket items, some perks are specifically geared toward making remote work sustainable and productive. These are often the tie-breakers when you’re stuck between two otherwise great offers.

Home Office Stipend: Does the company give you a one-time bonus or an annual allowance to kit out your workspace? This can cover an ergonomic chair, a good monitor, or a standing desk, saving you hundreds or even thousands of dollars you’d otherwise spend yourself.

Wellness Programs: This can be anything from gym memberships and fitness app subscriptions to serious mental health support. A company that invests in employee wellness is signaling a supportive culture that wants to prevent burnout. (You can learn more about what employee wellness programs are and why they’re so valuable).

Paid Time Off (PTO): Don't just get fixated on the number of vacation days. Ask about the culture around taking time off. Is it actually encouraged? Do people truly disconnect? An "unlimited PTO" policy sounds amazing, but it’s worthless if the team culture makes you feel guilty for using it.

By putting a dollar value on every benefit—from insurance savings to retirement matches and remote-work stipends—you can build a far more accurate picture of each offer. This kind of detailed evaluation ensures you pick the job that best supports your career and your life.

Assessing Company Culture and Your Future Manager

Let's be honest: a fantastic compensation package can quickly turn sour if you land in a toxic work environment. When you're weighing remote job offers, the company's culture and your direct manager are arguably the most critical factors for your day-to-day happiness and career growth.

In a remote world, you can't rely on office chatter or coffee breaks to get a feel for the company's real vibe. This means you have to dig deeper than the slick mission statement on their website. It's time to put on your detective hat during the interview process and find out what it’s really like to work there.

Reading Between the Lines of Company Culture

True company culture isn't about virtual happy hours or a free gym membership. It’s about how people actually communicate, work together, and treat each other. It’s about psychological safety—feeling like you can speak up, share a wild idea, or even admit you made a mistake without getting shut down.

You can start picking up clues from your very first interaction. Was the recruiter clear and respectful? Did the interview process feel organized, or was it a chaotic mess? These small details often reflect the company's overall operational style.

When it's your turn to ask questions, don't hold back. This is your chance to really understand the environment. For a deep dive, check out our guide on insightful questions to ask about company culture.

Here are a few areas to probe:

- Communication Norms: Instead of asking if they communicate, ask how. Try something like, "What does a typical project kickoff look like here? How does the team navigate disagreements or conflicting ideas?" This gets to the heart of whether they encourage open debate or stick to a rigid, top-down approach.

- Collaboration Tools and Practices: Ask about their primary tools for async and sync work. Are they a hyper-responsive, Slack-heavy culture? Or do they prioritize focused work and document decisions in tools like Notion or Asana?

- Work-Life Balance: Get specific. A great question is, "Could you share an example of how the team supported someone who needed unexpected time off?" A real story will tell you far more than any official policy document.

A company's values aren't what they write on a poster; they're what they do when things get tough. Pay close attention to stories about how they've handled pressure, missed deadlines, or navigated team conflicts.

Evaluating Your Future Manager's Leadership Style

Your direct manager can make or break any job. A great one is a coach, an advocate, and a shield, clearing roadblocks so you can do your best work. A bad one, well, they can become a daily source of stress and a dead end for your career.

When you're interviewing with your potential boss, remember to shift the dynamic. You aren't just there to be evaluated; you're interviewing them, too. You’re trying to figure out if their management style truly aligns with how you thrive.

Actionable Questions to Ask Your Potential Boss

To get a genuine feel for their leadership, you need to ask questions that pull out specific examples, not just high-level philosophies.

- Onboarding and Success: Ask, "What does the onboarding plan for this role look like? From your perspective, what would a successful first 90 days look like for me?" A clear, structured answer shows they’re invested in setting up new team members for success.

- Feedback and Growth: Try, "How do you prefer to give and receive feedback? Can you tell me about a time you helped someone on your team develop into a more senior role?" This reveals their actual commitment to professional development.

- Handling Challenges: A powerful question is, "Could you walk me through a challenging project the team faced recently and how you guided them through it?" This uncovers their problem-solving style and how they act under pressure.

Ultimately, your relationship with your manager is the bedrock of your role. Make sure you’re choosing a leader who will be a genuine partner in your career, not just a taskmaster. Comparing offers is about finding the environment where you can truly do your best work.

Analyzing Growth Opportunities and Company Stability

A job offer isn't just a contract for the next year—it's a potential launchpad for your entire career. It’s easy to get laser-focused on salary and benefits because they solve today's problems. But if you want to make a smart long-term investment in yourself, you have to look deeper at the company's stability and your personal growth path.

Thinking this way helps you see beyond the immediate numbers and figure out which role will best set you up for success three, five, or even ten years down the road.

A high-paying job at a struggling company or in a dead-end role can be a career trap. On the flip side, a position with slightly less pay at a stable, fast-growing company that genuinely invests in its people can slingshot your career and earning potential. The trick is knowing what to look for and which questions to ask.

Gauging The Company’s Health and Market Position

Before you sign on the dotted line, you need to put on your investor hat. Is this company a sound bet? Start by digging into its financial health. For public companies, this is fairly straightforward—you can sift through quarterly earnings reports and check their stock performance. It gets trickier with private companies and startups, but you can still find clues. Look for news about their latest funding rounds, who their key investors are, and what their reputation is in the market.

A company's stability isn't just about the money in the bank; it’s also about where they stand in their industry. Ask yourself a few critical questions:

- Is the company a recognized leader, or just another small fish in a crowded pond?

- What’s their reputation with customers and even competitors?

- Are they in a growing industry, or are they fighting against a strong headwind?

Keep an eye out for red flags like hiring freezes and sudden reorganizations. While not always a sign of impending doom, an unexpected freeze, especially for what seem like critical roles, can signal internal chaos or financial trouble. This is a huge factor when comparing offers, as one company might be hiring aggressively while the other is slamming on the brakes.

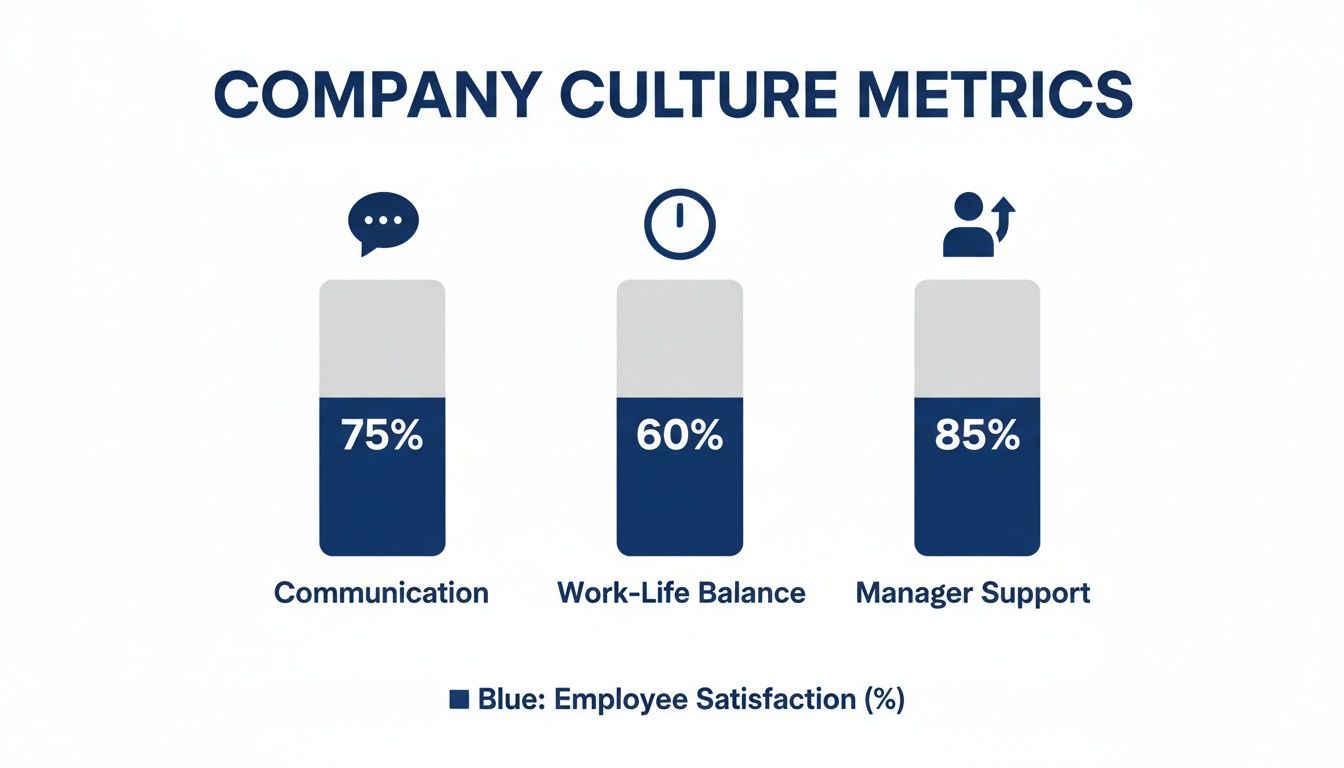

This chart visualizes some of the cultural metrics that often go hand-in-hand with company stability and growth.

As you can see, things like strong internal communication and supportive management are the bedrock of a healthy environment where people can actually do their best work and grow.

Mapping Your Potential Career Path

Once you feel good about the company's stability, it's time to zoom in on your own future there. A truly great job offer includes a clear vision for your professional development. I'm not just talking about a fancy title—I mean real opportunities to learn new skills, take on more responsibility, and see a clear path forward.

Your first job at a new company sets the tone for your future there. The right role should be a catalyst for your career, helping you build new skills and confidence—not just a paycheck that leads to exhaustion.

To get a real sense of your growth potential, you have to ask pointed questions, either during the final interview stages or after you have the offer in hand. Trust me, vague, hand-wavy answers are a major warning sign.

Questions to Ask About Your Growth:

- "What does a typical career path look like for someone in this role? Can you share examples of people who started here and moved into senior or different positions?" This forces them to give you real evidence, not just corporate boilerplate.

- "Is there a budget for professional development, like for certifications, courses, or attending conferences?" A real budget shows a real commitment to helping you grow.

- "How is mentorship handled? Will I have a dedicated mentor, or is it more of an informal thing?" A structured mentorship program can be a massive career accelerator, especially early on.

- "How are new responsibilities and promotions decided? Is there a formal review cycle, or is it more ad-hoc?" This will tell you if the path to advancement is transparent and based on merit.

By carefully weighing both the company's health and your own potential to grow, you elevate your decision-making beyond a simple salary comparison. It’s this dual analysis that completes the picture, helping you choose an offer that not only rewards you today but also builds the foundation for a prosperous and fulfilling career tomorrow.

Navigating the Negotiation Process with Confidence

Alright, you've done the hard work of meticulously comparing your offers and have a clear winner in mind. Now for the final step: the negotiation.

Let's be clear—this isn't about being confrontational or demanding. It's a calm, professional conversation where you confidently communicate your value. For a lot of people, this is the most stressful part of the job search, but it doesn't have to be.

The secret is to build your case on solid data, not just what you want. All that analysis you did on total compensation, market rates, and benefits? That's your ammunition. Whether you’re looking for a higher base, a sign-on bonus to make up for one you’re leaving behind, or a better remote work stipend, your request needs to be backed by sound logic.

Preparing Your Negotiation Strategy

Before you jump on a call or start typing an email, you need a game plan. Figure out your absolute "walk-away" number, but also pinpoint your main goal and a couple of secondary "nice-to-haves." This gives you room to be flexible.

- Start with excitement. Always kick off the conversation by saying how thrilled you are about the role and the company. This sets a collaborative tone, showing you're trying to find a solution that works for everyone.

- Present your case clearly. State what you're asking for and why. For example: "Based on my research for senior remote roles with similar scope, and given my specific experience in X, I was hoping for a salary closer to the [Your Target Number] range."

- Expect a counteroffer. They'll almost certainly come back with something. It’s a conversation, not a monologue. Listen to what they propose and be ready to discuss it.

A successful negotiation isn't about winning or getting every single thing you ask for. It's about finding that sweet spot where both you and the company feel the outcome is fair and respectful.

Common Mistakes to Sidestep

This final stage is all about careful communication. You'll often receive a conditional job offer before the final, legally binding agreement, so this negotiation phase is absolutely critical. Be sure to avoid these classic blunders:

- Giving an ultimatum. Phrasing your request as a "take it or leave it" proposition is a surefire way to damage the relationship before you even start.

- Nitpicking every detail. Focus your energy on the one or two things that matter most. Trying to haggle over every minor perk can make you seem high-maintenance.

- Saying "yes" too fast. Even if the offer is fantastic, it's completely normal to take 24-48 hours to review it thoroughly. This shows you're deliberate and gives you space to craft a thoughtful response.

When you approach negotiation with confidence, solid data, and a collaborative mindset, you can land the terms you’ve earned. It’s the best way to start a new remote job feeling truly valued and excited to hit the ground running.

Job Offer FAQs: Your Last-Minute Questions Answered

You’ve made it through the interviews and now the offers are rolling in. This is an exciting spot to be in, but it often comes with a flood of last-minute questions. Let's tackle some of the most common hurdles so you can make your final call with total confidence.

How Long Do I Have to Decide on an Offer?

Typically, companies give you a few days to a week to think things over. But here's a little secret: that deadline is almost always negotiable.

If you’re still in the final stages with another company or just need more time to weigh your options, don't be afraid to ask for an extension. A simple, professional email explaining your enthusiasm for the role while requesting a new decision date usually does the trick. Good companies want you to be 100% sure; they’d rather wait a few extra days for a committed "yes" than rush you into a "maybe."

Can I Tell Them I Have Another Offer?

Absolutely. In fact, you probably should. When you do it right, letting a company know you have a competing offer is one of the most powerful—and least confrontational—negotiation tools you have.

The trick is in the delivery. You're not trying to start a bidding war. Instead, you're transparently sharing your situation. Frame it by restating how excited you are about their opportunity, but mention you have another compelling offer on the table. This immediately signals your market value and often prompts them to sweeten their deal to avoid losing a top candidate. Just be honest—never, ever bluff about an offer you don't have.

A competing offer isn't a threat. It's leverage. Use it to open a conversation about your value, not to issue an ultimatum.

What Are the Biggest Red Flags in a Job Offer Letter?

The official offer letter should be the final, clear-cut summary of your new role. If it leaves you with more questions than answers, that's a problem.

Keep an eye out for these warning signs:

- Fuzzy Details: Is the bonus structure vague? Are your core duties poorly defined? Any ambiguity around compensation or responsibilities is a major red flag.

- The Exploding Offer: This is a high-pressure tactic where a company demands you sign on the spot or within an unreasonably short window, like 24 hours. A great employer will respect your need to review the details carefully.

- Verbal vs. Written: Does the letter contradict something you discussed with the hiring manager? If it's not in writing, it doesn't exist. Get everything clarified and documented.

For remote jobs, pay extra attention to anything unclear about time-zone requirements, whether the role is remote-first or remote-friendly, and how they handle home office stipends. A solid offer from a company that respects its people will be comprehensive and crystal clear.

Ready to find a remote role at a company that truly values its people? At RemoteWeek, we curate job listings exclusively from top-rated, employee-focused tech companies. Start your search with confidence and find a workplace where you can thrive. Explore vetted remote jobs today.